New Delhi: The World Trade Policy Uncertainty Index doubled to an average of 478 for the quarter Jan-March 2025 compared to the previous quarter of 237 (Oct-Dec’ 24), primarily due to developments in trade and tariff-related policies across multiple countries. These developments have heightened trade-related risks, affecting global trade and investment flows. Since then, heightened trade uncertainty has persisted in international trade, primarily due to US trade policy and geo-political developments, according to Niti Aayog’s Trade Watch Quarterly for Q4 of FY 2024-25 that was released on October 6.

The continued policy uncertainty could trigger structural shifts in global value chains, alter manufacturing landscapes, reshape export capacities and drag down world trade, the report adds.

“As the global economy contends with geopolitical tensions, evolving tariff regimes and rapid technological change, it becomes imperative for us to identify new drivers of export growth and to strengthen the foundations of our trade competitiveness,” says Suman K. Bery, vice-chairman, Niti Aayog.

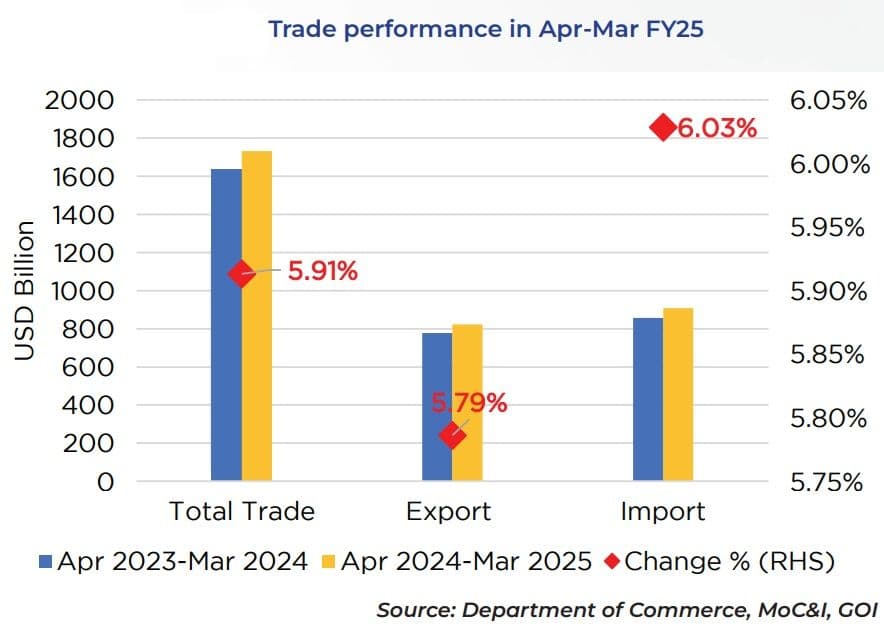

India’s external sector continues to demonstrate resilience, with FY25 trade reaching $1.73 trillion. Exports reached $823 billion, supported by record services exports of $387.5 billion and historic highs in non-petroleum merchandise exports at $374.1 billion. Imports rose to $908 billion, and the Q4 deficit moderated due to a strong performance of services exports.

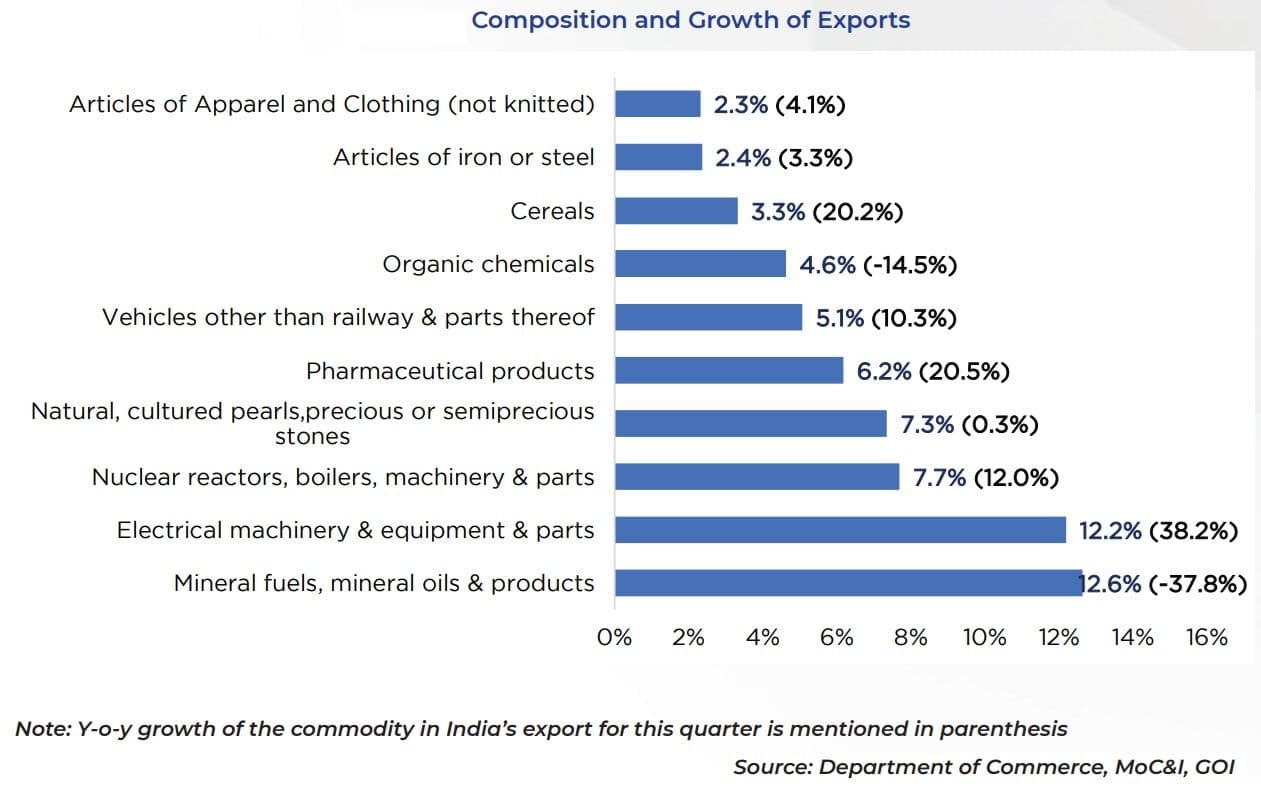

India’s export growth has been driven by electrical machinery, pharmaceuticals, and cereals, with emerging sectors like aerospace showing high potential. For the year 2024, India has achieved competitiveness in select high-demand products, with strong CAGR growth in mineral fuels, electrical machinery and nuclear reactors, and promising expansion in emerging areas such as aerospace and high-value manufacturing.

India’s trade trajectory highlights the twin imperatives of deepening India’s edge in knowledge-based services while diversifying the merchandise export base towards globally scalable sectors to strengthen its long-term trade resilience.

“India's evolving trade engagement reflects a deeper structural transformation anchored in competitiveness, innovation, and integration with global value chains. As global currents shift and uncertainties intensify, India is positioning itself not merely as a participant but as a shaping force in the emerging trade architecture. In this journey, policy instruments such as tariffs are being viewed as transitional tools meant to support domestic industries until they attain global competitiveness underscoring India's commitment to long-term trade maturity”, says Niti Aayog member Dr Arvind Virmani.

Focus: Leather Industry

This edition of Trade Watch also focuses on the Indian leather and footwear exports, which plays a pivotal socio-economic role, employing 4.4 million people, with nearly half of them being women. India holds strong global positions in leather garments, saddlery, and leather goods, with Tamil Nadu leading the way in production and exports. However, despite strengths in processed leather and niche high-RCA products, India’s global leather and footwear export share remained less than 2% since 2004, amounting to $5.5 billion in 2024 out of a $296.5 billion global market.

While global demand increasingly favours non-leather footwear, India’s focus on leather footwear, despite higher growth rates (~8%), has resulted in a largely stagnant overall market share. Although India has shifted from raw leather to higher value-added products, its export growth has only kept pace with global expansion, not surpassed it.

Globally, China dominates the mass footwear and travel goods market, Vietnam excels in textile- and leather-based footwear, and Italy leads in premium processed leather and apparel. India remains competitive in processed leathers (with a share of over 10%) and leather apparel, but its presence in footwear, especially in non-leather and high-demand categories, remains limited.

India imposes ~10% tariffs on key footwear inputs, while Vietnam and Italy levy near-zero rates. With similar reliance on China for sourcing, Vietnam’s lower duties give its producers a cost edge. For India, reducing tariffs, pursuing diversification, strengthening MSMEs, promoting sustainability, enhancing skills, improving infrastructure, implementing FTAs, investing in R&D, and enhancing branding are critical to boosting competitiveness.