New Delhi: In a strategic shift to tap into fast-growing digital and premium markets, several established fast-moving consumer goods (FMCG) companies in India are acquiring direct-to-consumer (D2C) brands that operate with fundamentally distinct business models. These deals are helping traditional FMCG giants expand into high-margin categories, enhance consumer engagement and accelerate innovation without materially straining their balance sheets, according to a study by Crisil Ratings.

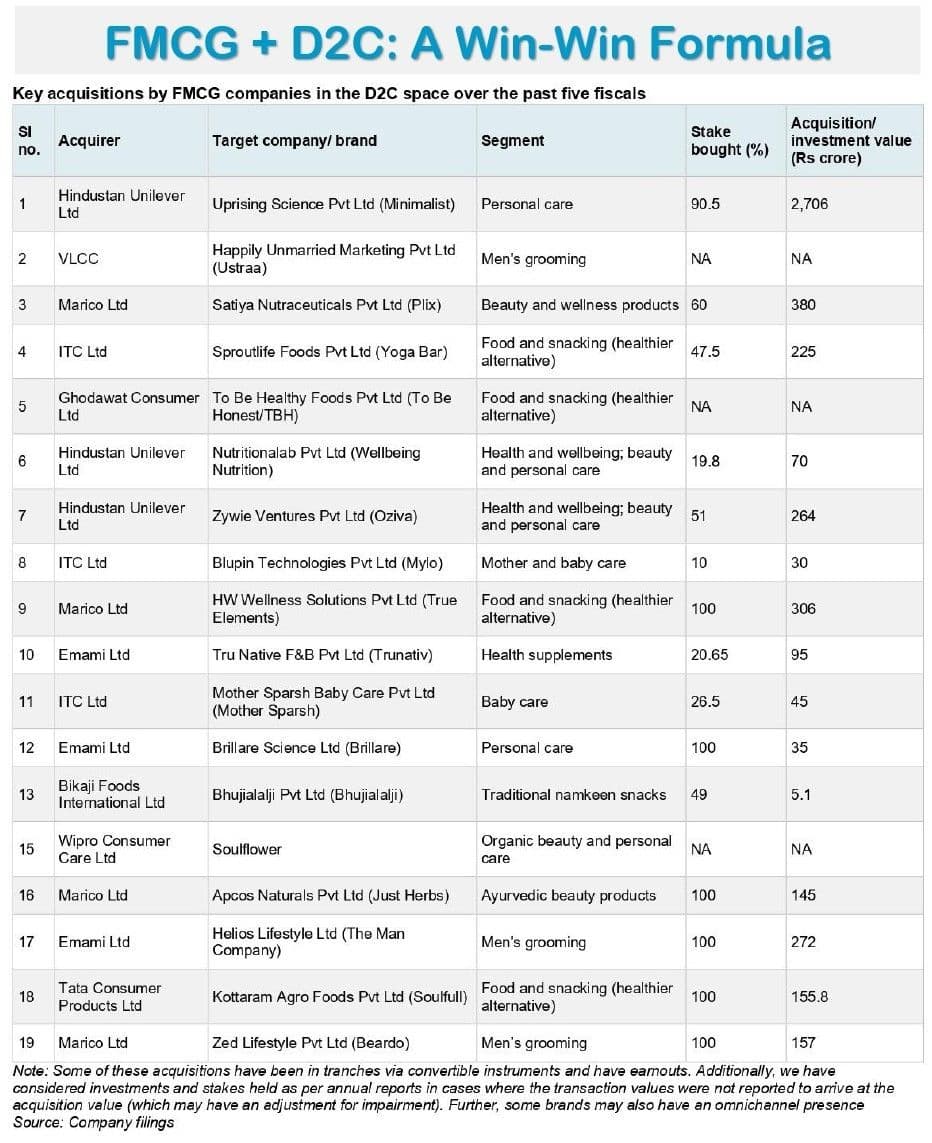

The study covered 82 FMCG companies in Crisil’s rated portfolio — representing about one-third of the sector’s revenue — and 58 D2C companies. It found that in the past five fiscal years, nearly two-thirds of all acquisitions made by FMCG firms were in the D2C space, reflecting a clear strategic pivot towards digital-first, premium brands.

“Acquisitions of D2C brands by FMCG players have led to a win-win for both sides,” said Anuj Sethi, senior director, Crisil Ratings. “FMCG firms have been able to enter new and premium categories as well as gain access to consumer insights, accelerating feedback loops. On the other hand, D2C companies have been able to mitigate challenges of scalability and profitability,” he added.

Digital-Native Brands Fuel Growth

The D2C model — built on direct engagement with customers through online platforms — has gained strong traction in India’s post-Covid consumer landscape. These digital-first brands have leveraged internet penetration, smartphone access, and influencer-driven marketing to create strong niche identities and differentiated products.

Crisil’s analysis shows that D2C companies logged an impressive ~40% compound annual growth rate (CAGR) between fiscals 2021 and 2024, albeit on a low base. In contrast, established FMCG players posted a more moderate ~9% CAGR over the same period. The surge in online demand and consumers’ growing willingness to pay a premium for perceived quality, innovation, and sustainability have been key drivers.

Most D2C brands occupy the premium end of their categories, typically priced 1.5x to 4.5x higher than established alternatives. Their success lies in their agility — enabled by real-time consumer data, rapid product development cycles, and highly targeted marketing. For large FMCG companies, acquiring such players offers an efficient route to strengthen their digital presence and capture evolving consumer preferences.

Despite their fast growth, the financial scale of D2C companies remains limited. Crisil found that fewer than 15% of D2C firms in its sample had surpassed ₹250 crore in revenue before acquisition, and only about one-third reported operating profits. The acquisitions, therefore, help D2C founders overcome challenges around profitability, supply chain management, and offline expansion — areas where large FMCG firms bring significant expertise.

Premiumisation, Product Diversification

According to Crisil Ratings director Aditya Jhaver, about 60% of the acquisitions by FMCG players have been in the personal care segment, while the remainder were in food and beverages, both key areas for premiumisation. Roughly 85% of these acquisitions were targeted at niche and premium categories, with 35% in health and wellness, 20% in specialised ingredients (such as organic and herbal inputs), and 10% in men’s grooming.

“These acquisitions are not just about adding new brands, they’re about repositioning portfolios for the next phase of consumption growth,” Jhaver noted. “Premiumisation is becoming central to long-term FMCG strategy,” he added.

The deals have allowed large players to diversify their product baskets and enter categories driven by health, sustainability and natural ingredients. For instance, FMCG firms have launched new variants such as pineapple and jamun-infused body washes or onion and rosemary-based hair oils, catering to niche customer segments seeking functional benefits and natural formulations.

By integrating these D2C brands, traditional FMCG companies gain access to specialised customer cohorts, real-time digital feedback, and agile product development processes — factors that are increasingly shaping the modern consumer market.

Financially, these acquisitions have had minimal impact on the credit profiles of the acquiring FMCG firms. Most D2C brands are still in early stages of scaling, resulting in modest deal sizes. Crisil noted that the average acquisition consideration has been less than 5% of the acquirer’s net worth, implying negligible strain on balance sheets.

“The modest scale of these acquisitions, relative to the financial size of the acquiring firms, has kept their credit profiles stable,” the report said. “As these acquired D2C brands ramp up and achieve scale, their profitability and integration success will be key monitorables,” it added.

Win-Win Trend

The D2C acquisition wave marks a structural shift in India’s FMCG landscape. Large consumer goods companies — traditionally reliant on extensive offline distribution — are now increasingly blending digital intelligence and innovation agility into their operations. For D2C founders, the partnerships offer capital, reach, and stability to grow faster.

While the long-term success of these integrations will depend on how effectively FMCG majors retain brand authenticity and leverage consumer data, the early outcomes suggest a mutually beneficial model. With digital consumption deepening and consumers trading up for better quality, the trend of FMCG-D2C convergence appears set to continue — reshaping how India’s consumer brands grow, innovate, and compete.