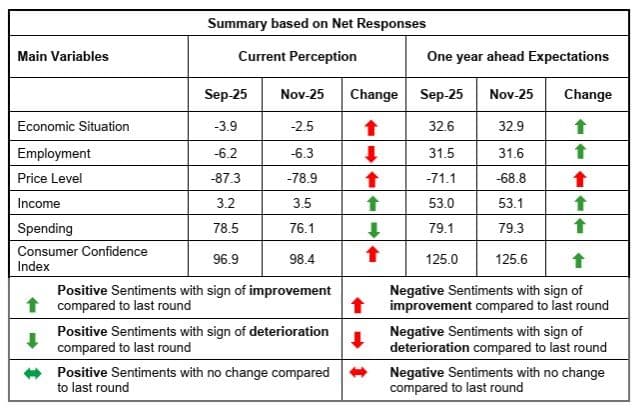

New Delhi: Urban consumer confidence edged up in November, driven by easing price perceptions and a firmer view of the general economic climate, according to the Reserve Bank of India’s latest urban consumer confidence survey.

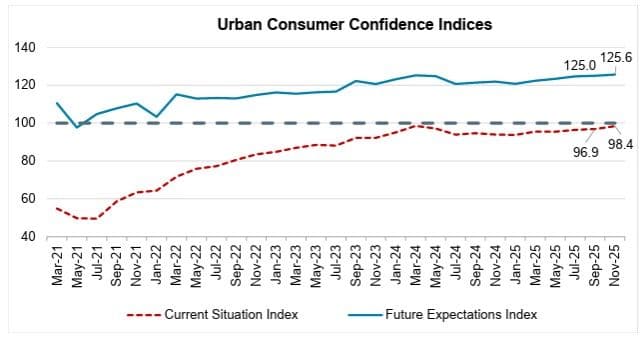

The ‘Current Situation Index’ rose to 98.4 from 96.9 in September, marking the second consecutive improvement after several muted rounds earlier in the year. Households reported notably better sentiment on price levels and the overall economic situation, offsetting still-weak readings on employment and income.

The Future Expectations Index remained firmly in optimistic territory, inching up to 125.6 from 125.0. The marginal rise suggests that households continue to hold a strong forward-looking outlook even as their current assessments remain just below the neutral mark of 100.

The divergence between present discomfort and future optimism, which has characterized much of 2024-25, persisted in the latest round.

A sharp moderation in negative perceptions of price levels was a key driver of improved sentiment. The proportion of households reporting higher prices fell to 83.9%, the lowest in several years, lifting the net response on price perception from -87.3 in September to -78.9 in November.

Expectations of future price increases also softened, with the net response improving to -68.8. This moderation reflects the impact of easing food and fuel pressures that had kept urban households cautious through the middle of the year.

Inflation expectations, too, saw mild improvement, with fewer respondents sensing accelerated price rises. Although the majority still foresee price increases, both current and forward-looking inflation sentiment improved incrementally, reinforcing the perception that households expect inflationary pressures to continue easing over the next year.

Employment sentiment remained largely unchanged. The net current response on jobs moved slightly to -6.3 from -6.2, underscoring persistent ambivalence about labour-market conditions. Forward employment expectations remained comfortably positive at 31.6, although the upward momentum seen in earlier months appears to have plateaued. Income perceptions were similarly range-bound.

Earnuings Stayed Modest

Households reporting higher earnings stayed modest at 26%, keeping the net response marginally positive at 3.5. Future income expectations barely moved, indicating that consumers are not anticipating significant improvement in their personal financial situations despite broader economic optimism.

Spending behaviour showed the first signs of cooling after months of sustained high readings. Current spending perceptions dipped, with the net response falling to 76.1 from 78.5, driven almost entirely by a sharp moderation in essential expenditure. As price pressures eased, fewer households reported rising spending on essentials, pulling the net response down to 83.5 from 86.7. Expectations for future essential spending also softened. However, non-essential spending expectations saw a modest improvement, suggesting that discretionary demand may gradually strengthen if inflation continues to retreat.

Overall, November’s survey points to a consumer environment that is slowly stabilizing after a prolonged period of price-driven pessimism. While households remain cautious about employment and income, the easing of inflationary stress appears to be restoring confidence, setting the stage for more broad-based sentiment gains if economic and labour-market conditions improve in the coming months.