New Delhi: Small Finance Banks (SFBs) have recorded an impressive surge in deposit mobilisation over the past three years, powered by rapid network expansion and deeper penetration into semi-urban and rural markets.

Between FY22 and FY25, the number of SFB branches grew 1.3 times to reach 7,641 outlets, helping the institutions broaden their retail customer base and build a more diversified liability franchise, according to CareEdge Ratings.

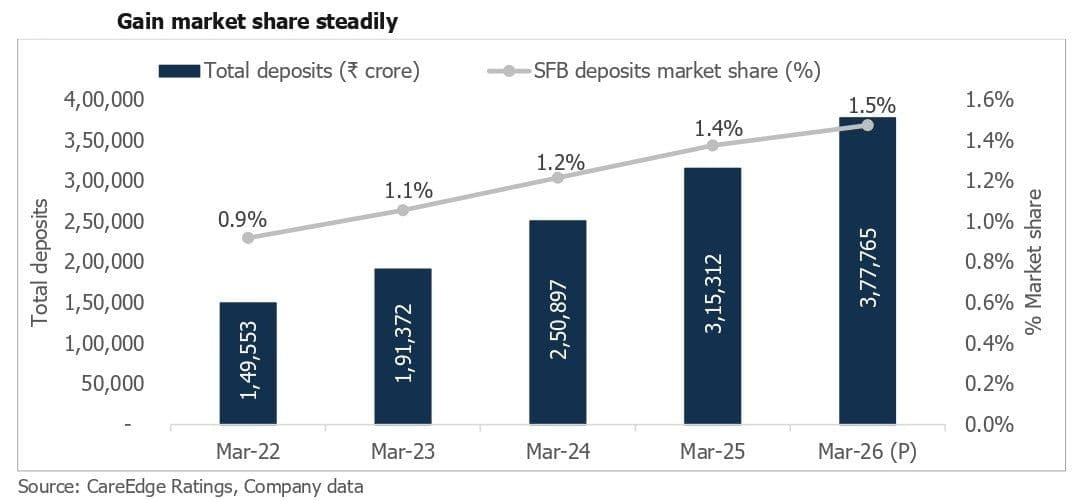

During this period, SFBs reported a compound annual growth rate (CAGR) of 28% in deposits, more than double the broader banking sector’s 12% growth. Deposits rose from ₹1.5 lakh crore in FY22 to ₹3.2 lakh crore in FY25, lifting the sector’s share of total system deposits from 0.9% to 1.4%.

However, despite the robust growth, the quality of deposits remains a key challenge.

However, the sector’s current account-savings account (CASA) ratio stood at 26.2% as of March 2025, notably below private and public sector peers. The lower CASA share translates into a higher cost of funds at 7.3%, compared to around 5.3% for the overall banking system.

As SFBs strive to improve profitability, expanding their low-cost CASA base will be crucial. The improving liability profile is already visible in the credit-to-deposit (C/D) ratio, which moderated to 86.3% in FY25 from 92.5% in FY22, indicating reduced reliance on borrowings.

According to CareEdge Ratings, deposit momentum is expected to remain strong in FY26, with growth projected at 21%, versus the industry’s 12%. The agency expects SFBs’ share in system deposits to rise further to 1.5% by FY26.

“While the pressure on profitability of SFBs is expected to continue in FY26, transition to the revised PSL norms will provide them more flexibility in lending and allow de-risking of their portfolio in the medium term,” said Sanjay Agarwal, senior director, CareEdge Ratings.

Growth Drivers: Diversification and Financial Inclusion

SFBs have consistently outperformed the wider banking industry in credit growth, driven by their mandate for financial inclusion and their expanding presence in underserved regions. Between FY22 and FY25, SFBs recorded a 25% CAGR in advances, compared to 16% for the overall banking system.

This growth has been underpinned by a strategic shift toward portfolio diversification. While microfinance loans remain a significant part of their books, the sector has seen strong traction in secured segments such as MSME, vehicle finance, and affordable housing. These segments have not only supported loan growth but also improved asset quality.

A strengthened deposit franchise has also helped reduce dependence on wholesale borrowings, enabling more stable credit expansion. Meanwhile, the Reserve Bank of India’s move in June 2025 to reduce the priority sector lending (PSL) requirement from 75% to 60% of adjusted net bank credit has offered additional operational flexibility.

This regulatory relaxation allows SFBs to rebalance their portfolios, expanding beyond microfinance and redeploying capital into lower-risk, higher-yielding assets.

“FY26 is expected to be a pivotal year, with many SFBs focusing on stabilising profitability and enhancing operational efficiency amid challenges in credit cost, which is expected to remain in the range of 1.8-2.0%,” said Priyesh Ruparelia, director, CareEdge Ratings.

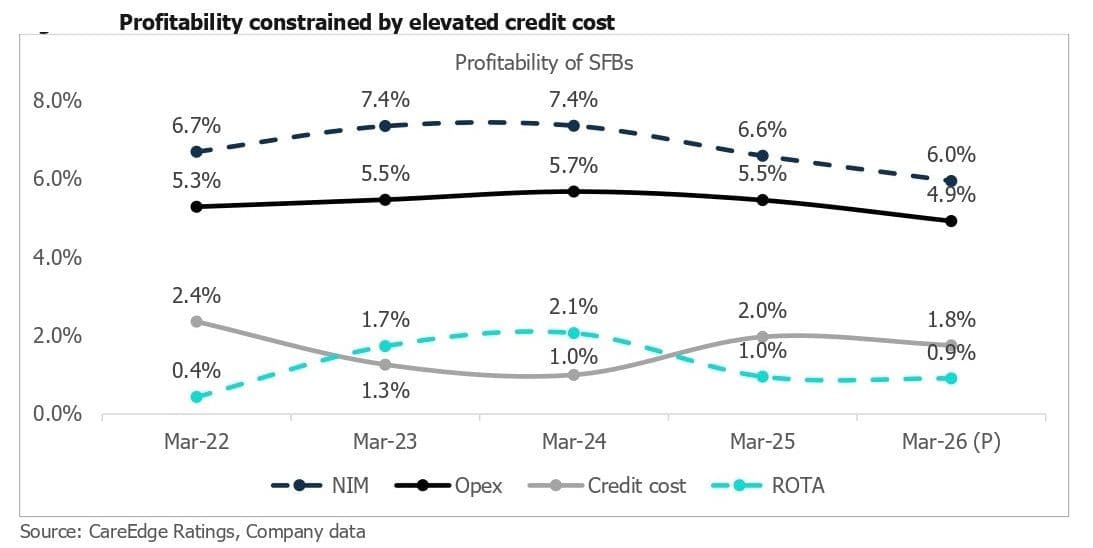

While diversification has slightly moderated yields, it has also reduced volatility. Net interest margins (NIMs) peaked at 7.4% in FY23-FY24, before easing to 6.6% in FY25, and are projected to settle around 6.0% in FY26.

However, the operating model remains cost-heavy. The branch-intensive structure, mandatory rural presence, and continued investment in digital platforms have kept operating expenses elevated at 5.5% of assets in FY25, compared to around 2% for larger banks.

As a result, profitability metrics have softened. Return on average assets (ROTA) fell from 2.1% in FY24 to 1.0% in FY25, while return on equity (RoE) remains below expectations. Excluding one large player, sector-wide ROTA is estimated to have dropped by an additional 30 basis points.

Asset Quality Stress: Microfinance Volatility Persists

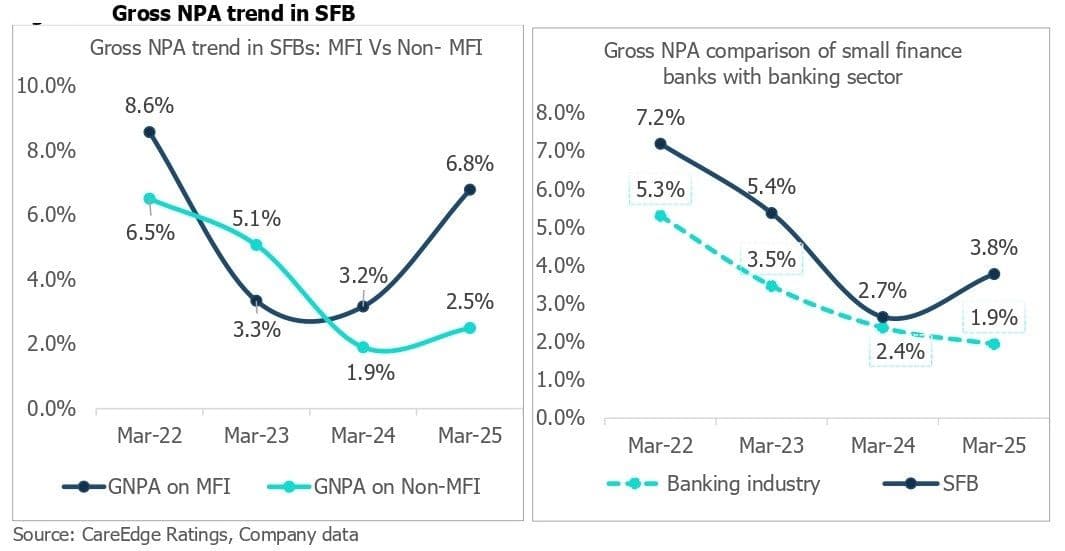

Asset quality remains a mixed picture for SFBs. While overall metrics have improved since the pandemic, stress in the microfinance segment continues to weigh on profitability. Gross non-performing assets (GNPA) for the sector declined to 3.8% in FY25 from a pandemic peak of 7.2% in FY22, demonstrating resilience in recovery.

Yet, the microfinance component remains a weak link. GNPA in this segment rose sharply to 6.8% in FY25, up from 3.2% in FY24, outpacing the broader MFI industry average by 60 basis points. Analysts attribute this to rising slippages among overleveraged rural borrowers and an uneven post-pandemic economic recovery in certain regions.

In contrast, non-MFI portfolios — such as MSME, vehicle, and housing loans — have shown steady performance. GNPA for these segments improved to 1.9% in FY24 before a marginal uptick to 2.5% in FY25, reflecting better underwriting and collateral coverage.

Despite these gains, elevated provisioning requirements from the MFI segment continue to pressure earnings. Credit costs are expected to stay high in FY26, offsetting some of the yield advantages enjoyed by SFBs.

“In the medium to long term, SFBs’ ability to improve liability efficiency, strengthen deposit quality, and manage microfinance-related risks and technology adoption will be crucial for sustaining profitability,” said Sudam Shingade, associate director, CareEdge Ratings.

Outlook: Balancing Growth and Stability

Having weathered multiple disruptions — from demonetisation to the NBFC crisis and the COVID-19 shock — SFBs have emerged as resilient institutions with a growing role in India’s banking landscape.

As they evolve toward universal banking characteristics, their success will hinge on balancing growth with prudence by deepening deposit quality, enhancing operational efficiency, and managing risk concentration.

The coming year, analysts say, will be decisive in determining whether SFBs can convert their rapid expansion into sustainable, broad-based profitability — a transition that could define their future in India’s financial inclusion story.