New Delhi: Silver’s explosive rise over the past year has reshaped its identity in global markets, turning a once-overlooked metal into a centrepiece of investor debate.

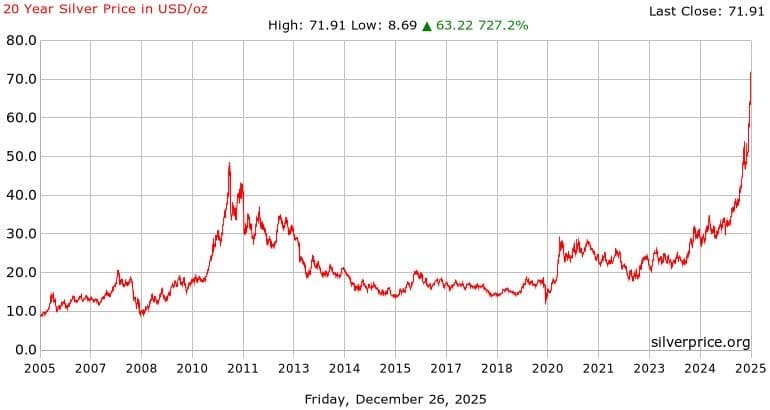

In India, prices scaling beyond ₹2.3 lakh per kilogram have shattered long-standing records, while international benchmarks hovering near $80 an ounce reflect the intensity of the global surge. What stands out is not just the magnitude of the move, but the speed with which it has unfolded. Silver, considered gold’s quieter cousin, has moved from gradual appreciation to near-vertical acceleration, forcing traders, manufacturers, and policymakers alike to confront a new reality in which the metal’s value is being reassessed in real time.

This re-rating has unfolded against a backdrop of growing uncertainty across financial markets. Persistent geo-political stress, expectations of easier monetary policy in the United States, and a softening dollar have collectively revived interest in tangible assets. Gold’s dramatic rally has reinforced the broader appeal of precious metals, but silver has gone a step further, outperforming nearly every major asset class. Its relatively small market size has magnified the impact of capital inflows, meaning that even modest shifts in global sentiment have translated into sharp price movements. In India, where silver straddles the line between investment asset, industrial input, and cultural store of value, these global forces have been felt with particular intensity.

Beneath the market excitement lies a structural imbalance that has been building quietly for years. Global silver supply has failed to keep pace with demand, resulting in repeated annual shortfalls. Mining output has struggled to expand, constrained by declining ore quality, limited new project development, and long gestation periods for bringing new capacity online. Unlike gold, which benefits from substantial above-ground stocks accumulated over centuries, silver’s accessible inventories are far thinner. A significant portion of annual production is absorbed by industry and effectively removed from circulation, leaving little flexibility when demand rises. This scarcity has given the recent rally a fundamentally different character from earlier price spikes driven primarily by speculation.

Critical Input

The industrial transformation of silver is perhaps the most important story underpinning its ascent. No longer confined to jewellery, tableware, or coinage, silver has become a critical input for technologies shaping the global economy. Renewable energy has emerged as a dominant force, with advanced solar panels consuming increasing amounts of silver to improve efficiency. As countries accelerate their clean-energy targets, solar installations continue to expand, locking in long-term demand for the metal. At the same time, the rapid growth of data-intensive technologies has elevated silver’s importance in electronics, servers, and high-performance computing systems, where its conductivity and durability are difficult to replicate.

Electric mobility has added another powerful layer to this demand profile. Electric vehicles, charging infrastructure, and associated power systems all rely on silver-based components. Unlike traditional investment demand, much of this industrial usage is consumptive. Once silver is embedded in circuitry or industrial equipment, recovery is often impractical or uneconomical. Recycling remains fragmented and limited, especially for small-scale applications, which means that rising industrial demand effectively tightens supply over time. This dynamic has prompted governments to reassess silver’s strategic importance, with policy decisions increasingly reflecting its role in energy security and technological competitiveness.

Financial conditions have reinforced these structural drivers. As expectations build for interest rate reductions in the United States during 2026, investors have grown more willing to allocate capital to non-yielding assets. Lower rates tend to weaken currencies and raise concerns about long-term purchasing power, conditions that historically favour precious metals. Silver’s appeal in this environment is unique because it combines defensive characteristics with exposure to economic expansion. This dual nature has broadened its investor base, drawing in both those seeking protection and those chasing growth, and in doing so has intensified price momentum.

Significant Risks

Yet the very forces that have propelled silver higher also introduce significant risks. The rapid pace of gains has raised questions about sustainability, particularly as prices approach psychologically important thresholds. Retail investors have become increasingly vocal in their optimism, with many openly discussing the possibility of silver reaching $100 an ounce in the coming year. Their confidence is rooted in tangible trends: persistent supply gaps, strong investment inflows, and industrial demand that appears resilient even at elevated prices. From this perspective, silver’s surge represents a long-overdue adjustment rather than a speculative bubble.

Institutional voices, however, paint a more cautious picture. Some market strategists argue that silver’s recent trajectory shows hallmarks of overheating, including extreme momentum indicators and sharp, short-term price spikes. History suggests that such conditions often precede periods of consolidation or abrupt pullbacks. There is also concern that sustained high prices could alter behaviour among industrial users. Manufacturers facing higher input costs may accelerate efforts to reduce silver usage, redesign products, or substitute alternative materials where possible. Even modest reductions in consumption could have an outsized impact given the market’s tight balance.

Volatility has become an unavoidable feature of the silver market. Thin physical inventories mean that supply disruptions or sudden shifts in sentiment can trigger abrupt price swings. At the same time, growing participation through financial instruments such as exchange-traded funds and derivatives has increased the speed at which capital can enter or exit the market. This combination makes silver particularly sensitive to changes in expectations around monetary policy, economic growth, and geo-political risk. For investors, the challenge lies in navigating these swings without losing sight of the longer-term fundamentals.

For participants in India, silver’s evolving profile demands a reassessment of strategy. Traditionally seen as a complement to gold, silver now behaves more like a high-octane asset, capable of delivering rapid gains but also sharp corrections. Analysts often emphasise the importance of distinguishing between trading and investing objectives. Gold continues to offer relative stability and a well-established role as a hedge, while silver offers greater upside potential at the cost of higher volatility. A diversified approach that recognises these differences may be better suited to the uncertain environment ahead.

As the market looks toward 2026, silver stands at a pivotal moment. Structural supply constraints, expanding industrial use, and supportive monetary conditions suggest that the metal’s long-term outlook remains strong. At the same time, elevated prices and heightened speculation increase the likelihood of turbulence along the way. Rather than a smooth ascent, silver’s future may be defined by sharp advances followed by equally sharp pauses. What is clear, however, is that silver has moved beyond its historical shadow.

In a world shaped by energy transition, technological change, and financial uncertainty, silver has reclaimed its place as a metal of consequence, commanding attention not just for its price, but for its role in the global economic transformation.

(Cover photo by Scottsdale Mint on Unsplash)