Photo courtesy: PickPik

New Delhi: India’s processed potato exports are on a surge, transforming the humble tuber into one of the country’s fastest-growing agri-business success stories.

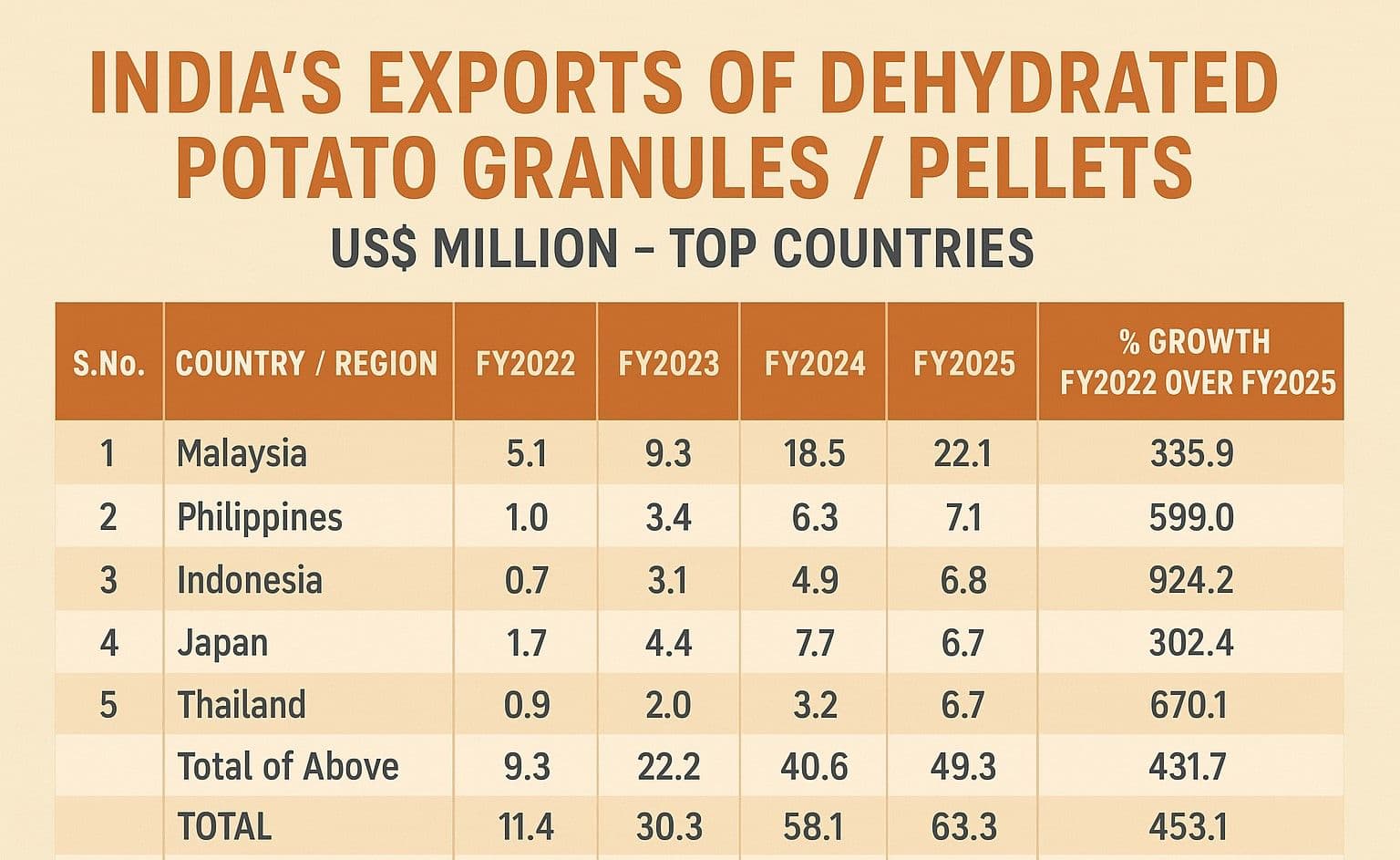

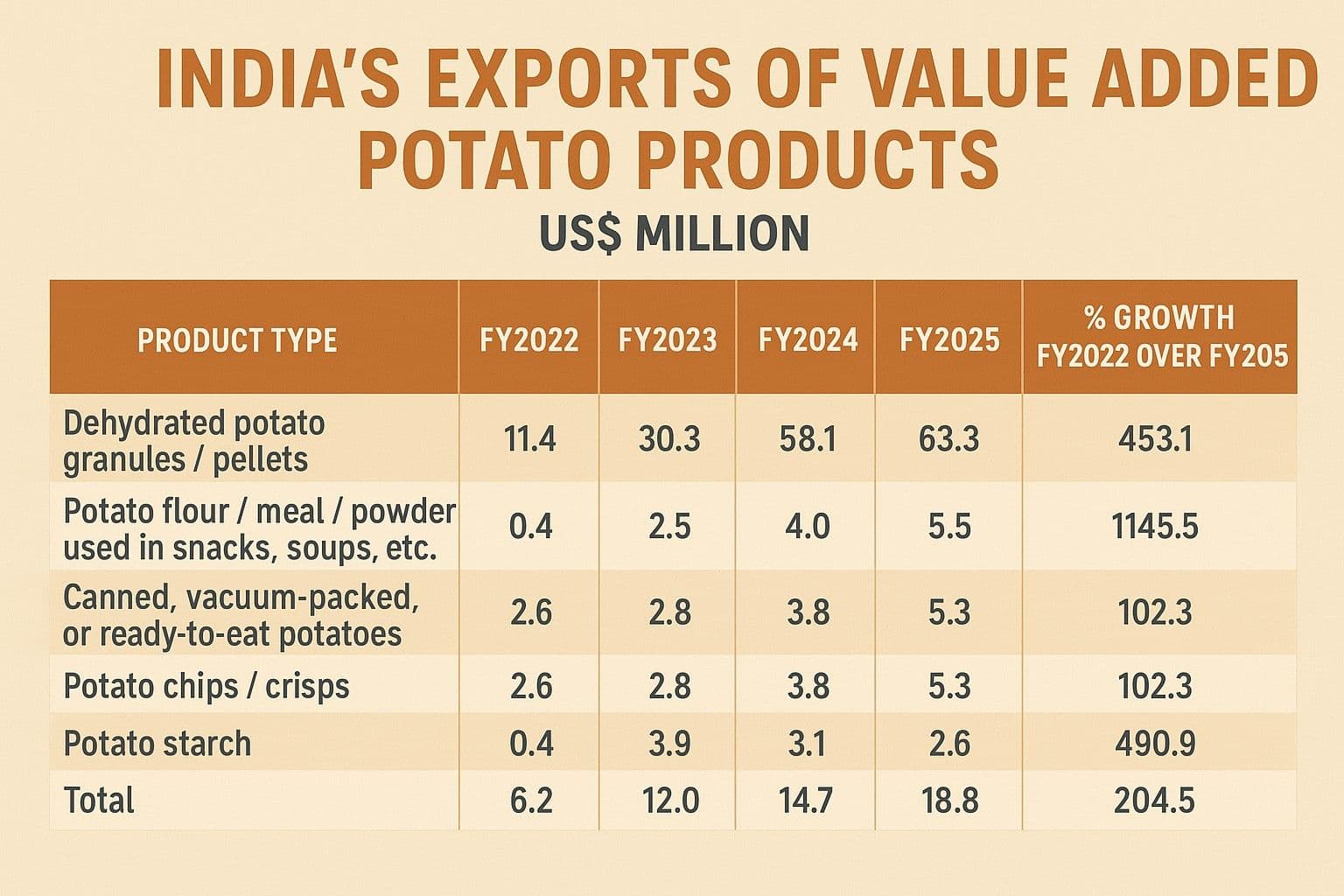

Exports of dehydrated potato granules and pellets — used in snacks, soups and quick-service restaurant (QSR) foods — have jumped more than 450% in just three years, from $11.4 million in FY2022 to $63.3 million in FY2025, according to data released by Global Trade Research Initiative (GTRI). The segment now leads India’s value-added food exports, outpacing even traditional processed categories such as rice-based or fruit products.

Nearly 80% of shipments go to Malaysia, the Philippines, Indonesia, Japan and Thailand, positioning India as a key supplier in Southeast Asia’s booming snack and convenience food market. Indonesia alone recorded an astonishing 924% rise in imports of Indian potato products since 2022.

Meanwhile, exports of other processed potato items — including flour, starch, chips and canned potatoes — have tripled over the same period, climbing from $6.2 million to $18.8 million. Potato flour has been the breakout star, rising more than 1,100%, driven by demand from instant food and bakery manufacturers.

India Fills Global Supply Gap

Industry experts say India’s rise comes at an opportune moment. Europe’s processors are struggling with high energy costs and erratic harvests, while China has prioritised domestic supply. This has opened space for India, which offers year-round output, lower costs, and proximity to ASEAN markets.

“India has quietly become the back-end factory for Asia’s snack industry,” said a senior executive at a leading food exporter. “What used to be a marginal byproduct trade has turned into a high-margin, fast-scaling export segment.”

States Drive Growth

The boom is being powered by Gujarat and Uttar Pradesh, which have rapidly expanded processing capacity. Modern dehydration plants in Mehsana, Banaskantha, Agra and Farrukhabad, coupled with contract farming and new cold chains, have given India a robust export base supported by its 56-million-tonne annual potato crop.

Analysts view the surge as a rare instance of agricultural value addition driving export growth. India’s processors have upgraded facilities to meet global quality standards — including BIS, ISO, and HACCP certifications — and are tailoring granules, flakes, and pellets to multinational buyers’ specifications.

With exports touching $30 million in just the first five months of FY2025, India’s processed potato industry is poised for another record year. What began as a small trade in dehydrated products has now matured into a strategic export engine, feeding Asia’s appetite for affordable, ready-to-eat foods.