New Delhi: The Securities and Exchange Board of India (Sebi) has issued a public caution advising investors to stay away from unregulated digital or online platforms offering investments in ‘digital gold’ or ‘e-gold’ products. The market regulator clarified that such products do not fall under its regulatory framework and could expose investors to significant risks.

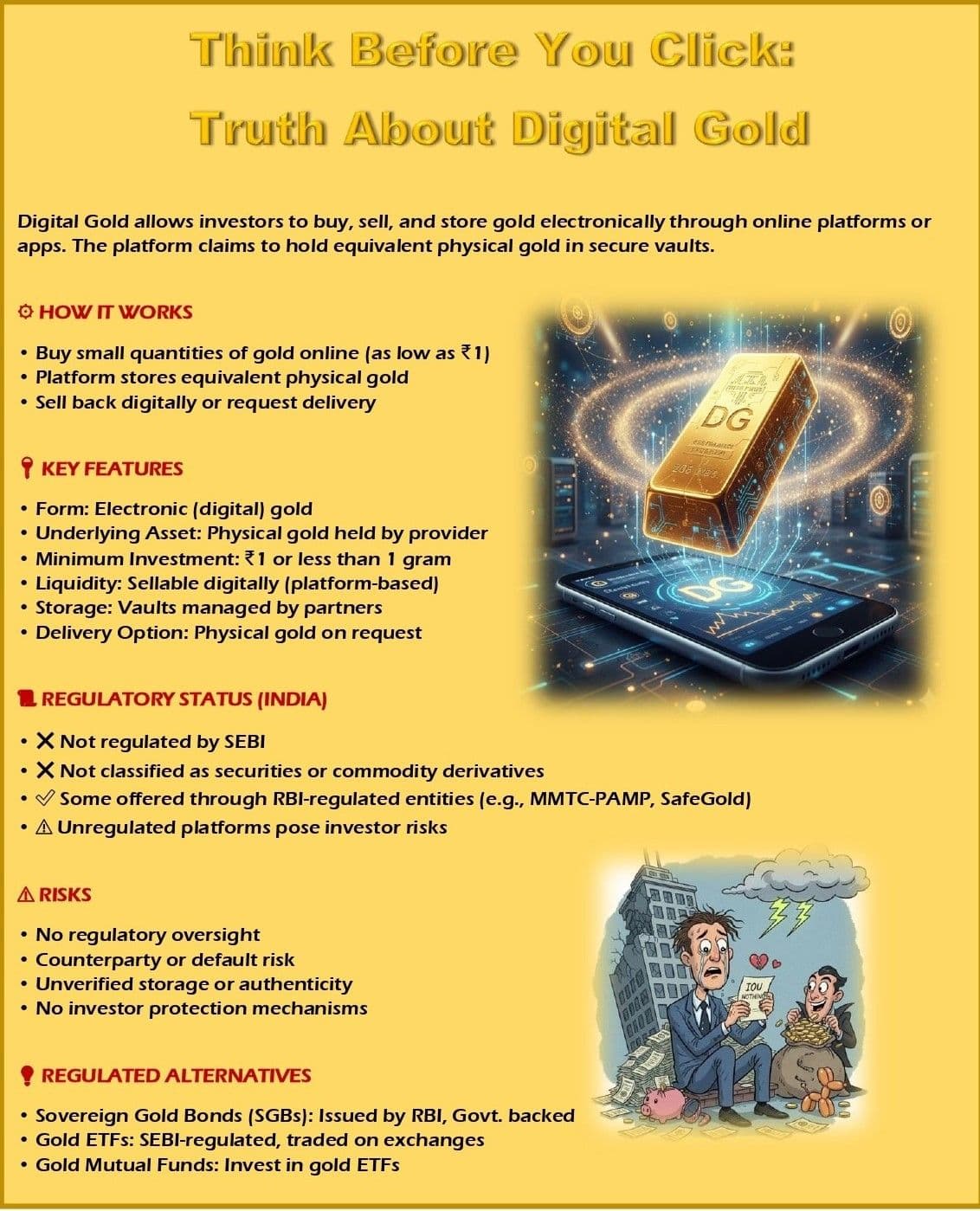

In its statement, Sebi noted that certain online platforms have been marketing digital gold as an alternative to physical gold, luring investors with promises of easy and convenient investment options. The regulator, however, emphasized that these products are neither classified as securities nor regulated as commodity derivatives, and therefore, operate entirely outside its jurisdiction.

“Such digital gold products are different from Sebi-regulated gold products as they are neither notified as securities nor regulated as commodity derivatives. They operate entirely outside the purview of Sebi,” the regulator stated.

Sebi also reminded investors that it already provides several regulated avenues for gold investment, including exchange-traded commodity derivative contracts, gold exchange traded funds (ETFs) offered by mutual funds, and electronic gold receipts (EGRs) that are tradable on stock exchanges. These instruments can be accessed through Sebi-registered intermediaries and are governed by the regulator’s prescribed framework.

Highlighting the potential dangers, Sebi warned that investing in unregulated digital gold schemes could expose investors to counterparty and operational risks, and that none of the investor protection mechanisms available under the securities market framework would apply to such investments.

The regulator urged investors to exercise caution and invest only through regulated products and intermediaries to ensure the safety and legitimacy of their investments.