New Delhi: Rural consumer confidence remained largely unchanged in November even as households reported a sharp moderation in their inflation perception and expectations, according to the Reserve Bank of India’s latest rural consumer confidence survey (RCCS). Conducted between November 1 and 10 across 8,754 respondents in rural and semi-urban areas, the bi-monthly exercise shows that the rural economy continues to display steady sentiment with signs of improving optimism about the year ahead.

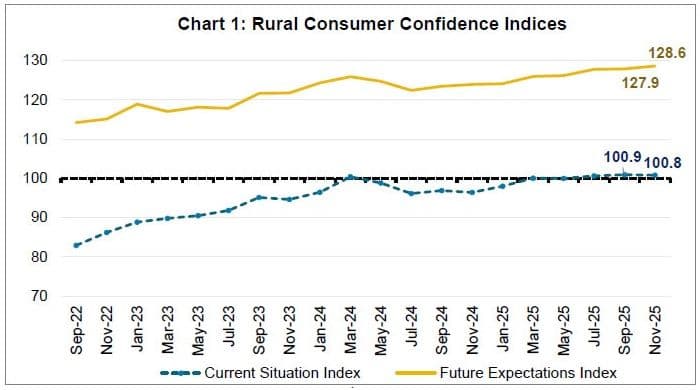

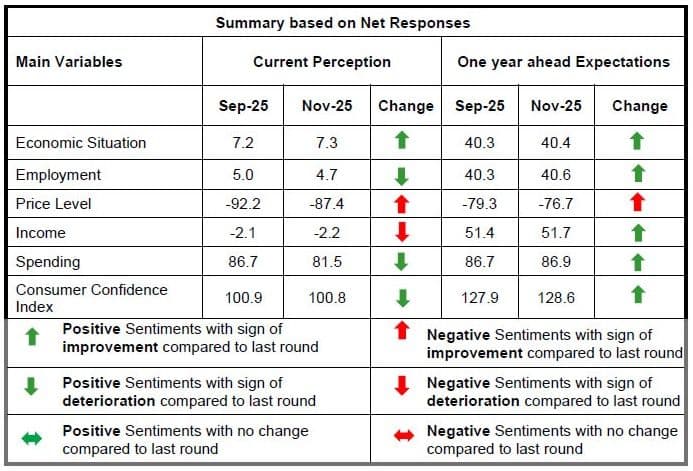

The Current Situation Index (CSI) stood at 100.8, almost unchanged from 100.9 in the September round, marking the third consecutive reading above the neutral 100 mark. This suggests that rural households perceive the present economic and income environment to be stable relative to a year ago. The Future Expectations Index (FEI) rose to 128.6 from 127.9, indicating a strengthening forward-looking outlook in the optimistic zone. The widening gap between CSI and FEI reflects a rural economy that is treading cautiously in the present but is markedly more hopeful about the next year.

A key driver of this improvement is the substantial decline in inflation perceptions. Households’ current inflation perception dropped by 130 basis points to 4.6% — the sharpest fall in recent rounds — while one-year-ahead expectations fell even more steeply by 150 basis points to 6.1%. The share of households expecting a decline in prices and inflation increased for both current and future periods, suggesting that the inflationary climate is no longer viewed as a dominant concern in rural pockets. This shift also aligns with improved sentiment regarding spending power, even though current spending perceptions showed a mild softening.

Across categories, income perceptions remained broadly stable, with the net response slipping marginally to -2.2 from -2.1. However, expectations for income a year ahead continued to improve, with the net response rising to 51.7. Employment perceptions were similarly steady, though marginally weaker than in September, while expectations for job conditions showed a slight uptick. These trends indicate that while rural households do not see immediate gains in the labour market, they anticipate better prospects by next year.

One of the most consistent findings of the survey is the resilience in spending behaviour. Although current spending sentiment eased to 81.5 from 86.7, households remain firmly expansionary in their assessment of both essential and non-essential purchases. Year-ahead spending expectations held strong at 86.9, pointing to a sustained appetite for consumption as inflation concerns recede.

The detailed cross-tabulation of inflation responses underscores a notable dispersion in individual assessments of current and future price movements, but the median trends point uniformly downward. This suggests that while inflation remains a lived reality across income and age groups, its perceived intensity is diminishing.

Overall, the November survey depicts a rural economy in transition: stabilising after inflationary pressures and positioning for better conditions in the coming year. The combination of steady current sentiment, improving expectations, and sharply lower inflation perceptions provides a positive backdrop as policymakers assess rural demand impulses ahead of the next policy cycle.