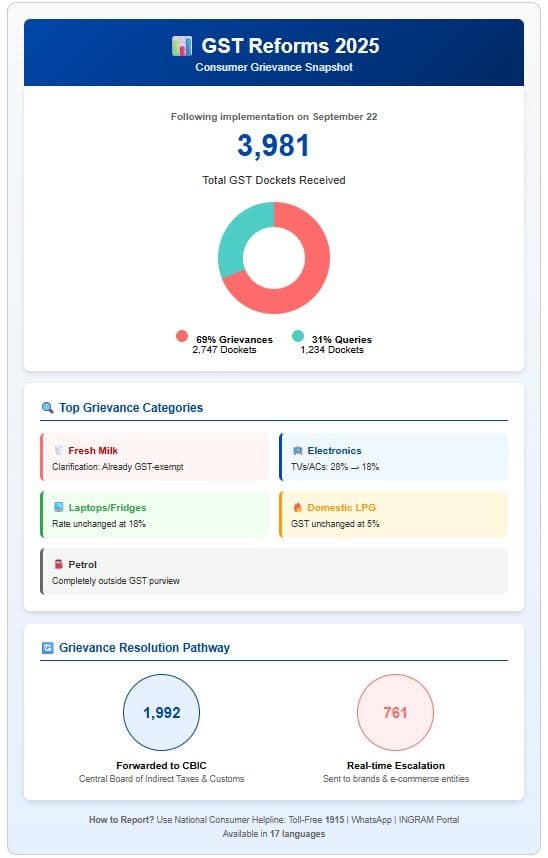

New Delhi: Following the implementation of the Next-Generation GST Reforms 2025 on September 22, the National Consumer Helpline (NCH) has received 3,981 GST-related dockets -- comprising 31% queries and 69% grievances. The Department of Consumer Affairs is closely monitoring these grievances for early resolution and clarification, while the Central Consumer Protection Authority (CCPA) is reviewing them for potential class action.

A major share of complaints stemmed from public confusion over GST rate changes. Many consumers believed fresh milk prices should have been reduced post-reform. However, CCPA clarified that fresh milk was already exempt from GST, and the recent reforms have merely extended the exemption to UHT milk.

Another significant category involved electronic goods sold via e-commerce platforms. Consumers alleged they were still being charged pre-reform GST rates. Upon investigation, CCPA found that items like TVs, ACs, and dishwashers saw a rate cut from 28% to 18%, but other products like laptops and refrigerators were already taxed at 18%, and hence saw no change.

Grievances related to LPG pricing were also prominent. Consumers expected a price drop but were informed that the GST rate on domestic LPG remains unchanged at 5%. The authority clarified that LPG prices are influenced by various factors including international oil prices and government subsidies, not just GST.

A section of complaints focused on petrol prices. CCPA reiterated that petrol falls outside the purview of GST altogether, and price fluctuations are unrelated to the recent reforms.

Of the total grievances, 1,992 were forwarded to the Central Board of Indirect Taxes and Customs (CBIC), while 761 were escalated in real time to concerned brands and e-commerce entities. CCPA affirmed its commitment to addressing genuine overcharging and non-compliance, promising strict action under the Consumer Protection Act, 2019 where violations are established.

Under its secretary Nidhi Khare, the Department has engaged with industry bodies such as Ficci, CII, Assocham, CAIT, and RAI to ensure that tax benefits are passed on to consumers. A roundtable on September 24 also brought together stakeholders to promote compliance and transparency.

The Department encouraged citizens to continue using the NCH’s multi-channel platforms, including the toll-free number 1915, WhatsApp, INGRAM portal, and various apps, available in 17 languages. The proactive role of consumers, the Department said, was vital to ensuring that GST reforms lead to greater fairness, transparency, and consumer empowerment across the country.