New Delhi: India’s manufacturing engine continues to hum with confidence. The 67th edition of Ficci’s Quarterly Survey on Manufacturing (QSM), covering performance for Q2 FY 2025-26 (July–Sept), paints an upbeat picture of sustained growth, robust domestic demand and positive investment sentiment across eight key sectors including automotive, capital goods, chemicals, fertilizers & pharmaceuticals, electronics, machine tools, metals and textiles.

Compared to Q1 FY 2025-26, in which 77% of manufacturers reported higher or stable output, the latest survey shows that 87% of respondents recorded equal or higher production levels in Q2. This uptick reflects the combined push from stronger domestic orders and the government’s latest GST rate cuts, which seems to have bolstered market sentiment.

Notably, 83% of manufacturers expect orders to increase further in the coming months, signalling strong domestic consumption momentum heading into the festive and export-heavy season.

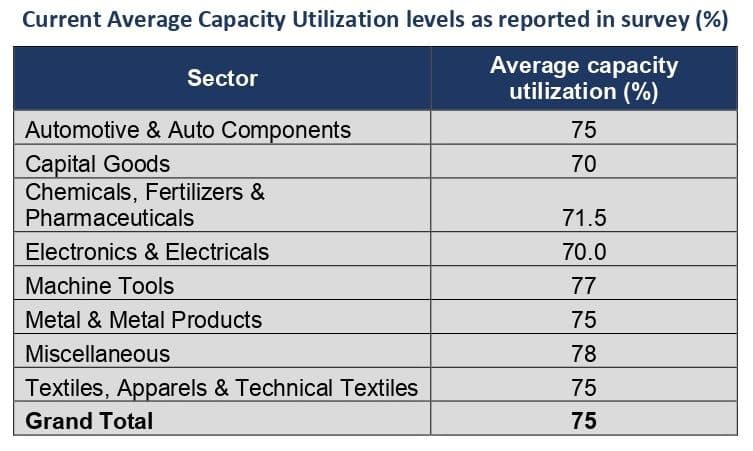

The average capacity utilization across manufacturing remains steady at around 75%, suggesting sustained operational strength. The export outlook is also firming up. While 61% of respondents reported stable or higher exports in Q1, over 70% expect export performance to remain robust in Q2, compared to the same period last year.

Investments, Hiring & Funding Outlook

India’s manufacturing rebound is not just about output. It’s translating into expansion and employment too.

More than half of the respondents plan fresh investments or capacity expansion in the next six months, underlining growing confidence in the economic outlook.

On the employment front, 57% of manufacturers said they intend to hire additional workforce in the next three months, a sign of widening recovery in job creation.

Meanwhile, the average borrowing cost stands at 8.9%, and a significant 81% of respondents confirmed adequate fund availability from banks for both working capital and long-term requirements — a reassuring trend amid tighter global credit conditions.

Cost Pressures Persist, but Confidence High

While optimism abounds, manufacturers continue to battle elevated input costs.

About 52% of respondents reported a rise in production costs as a percentage of sales, consistent with the previous quarter’s findings. The rise stems from higher raw material prices (including bulk chemicals, metallurgical coke, and iron ore), increased labour costs, and expensive logistics and utilities.

Despite these headwinds, firms are maintaining momentum, reflecting operational resilience and adaptive pricing strategies.

Though 80% of manufacturers report no significant labour shortage, about one-fifth still face a shortfall of skilled workers. The survey highlights a clear call for stronger industry-government collaboration to enhance skilling initiatives, especially in high-tech and export-oriented manufacturing segments.

Outlook: Cautious Optimism

Overall, Ficci’s QSM shows a broad-based revival in India’s manufacturing ecosystem, supported by resilient domestic demand, export potential, and capacity expansion plans.

Even with cost pressures and global uncertainties, the sector’s fundamentals — rising orders, improved credit access, and strong hiring intent — signal that India’s manufacturing story is firmly on the growth track.