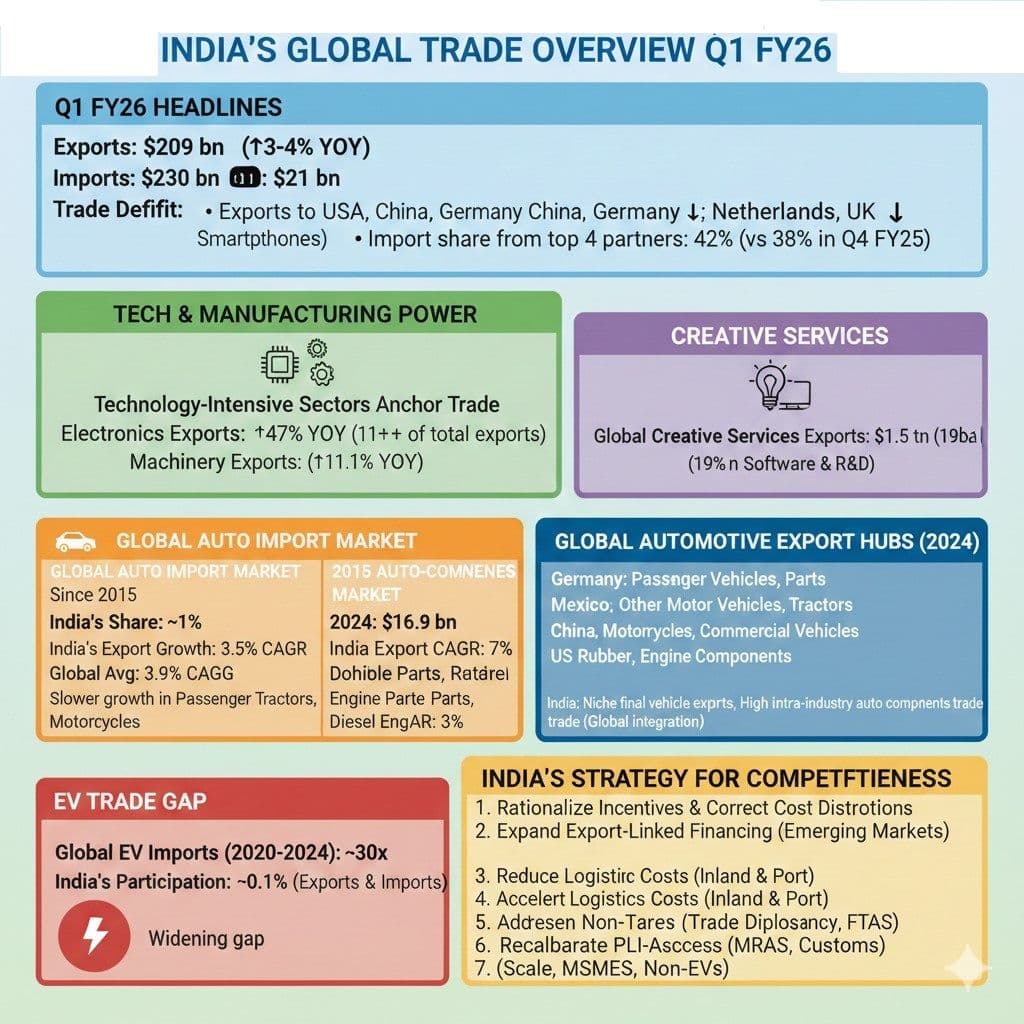

New Delhi: Against the backdrop of global trade in goods and services maintaining its momentum in April-June 2025, expanding by about 2.5% quarter-on-quarter, India’s overall trade position in Q1 FY26 remained stable and resilient. Total merchandise and services trade reached $439 billion, registering year-on-year growth of 3.5%, as highlighted in the latest edition of NITI Aayog’s Trade Watch Quarterly for the first quarter (April-June) of FY 2025-26. The report was released here by NITI Aayog member Arvind Virmani.

Services continued to be the primary growth engine, with exports rising by 10% and generating a substantial surplus of $48 billion. In contrast, merchandise exports declined by 2.1% to $112 billion, reflecting subdued global demand conditions and sector-specific disruptions. Merchandise imports grew marginally by around 5%, driven largely by higher demand for industrial inputs and technology-intensive goods.

This divergence between goods and services performance points to a deeper transformation in India’s trade structure, where high-tech, capital-goods, and knowledge-based services are offsetting weaknesses in petroleum exports and labour-intensive manufacturing.

India’s trade performance during April-June 2025 also reflects a reorientation on the import side, with rising purchases of electronics, machinery, and chemicals. This shift signals deeper integration into global value chains and ongoing upgrading of domestic manufacturing capabilities.

“India’s trade engagement is being reshaped by structural shifts aimed at improving competitiveness, accelerating technological upgrading and and embedding Indian producers more firmly within global value chains,” said Virmani.

“As global trade patterns adjust to geopolitical uncertainty and supply-chain reconfiguration, India’s trade strategy is moving beyond an emphasis on volumes towards resilience, higher value creation, and durable export growth,” he added.

Complementing these trends, the report highlights the growing importance of the creative economy in global trade. Digitally delivered, skill-intensive services such as software, research and development, and digital content now generate export revenues far exceeding those of creative goods. India has emerged as a major global player in creative services, leveraging its strengths in technology-enabled and innovation-driven activities, as noted in the Trade Watch.

Auto Exports

A key thematic focus of this quarter’s report is India’s automotive exports, a sector of rising global relevance. Globally, automotive import volumes were valued at about $2.2 trillion in 2024, with India contributing roughly $30 billion in exports, accounting for around 1.4% of world demand. Indian automotive exports have a broad international footprint, with key destinations including Japan, Mexico, and several markets across Africa and Latin America.

However, the composition of global demand reveals a significant asymmetry. Passenger vehicles account for nearly 71% of global automotive demand, yet India has captured only about 1% of this market. In contrast, motorcycles represent around 3% of global demand, where India’s export share stands at a much stronger 9%. This imbalance underscores the need to reorient India’s automotive export basket toward higher-demand segments, particularly passenger vehicles.

The report notes that India’s automotive industry has traditionally focused on serving the domestic market, supported by a tariff regime that promotes domestic manufacturing and sales. While applied tariffs remain high and intra-industry trade is limited, existing export patterns reveal clear areas of specialization that can serve as a foundation for diversification and deeper global integration. India’s backward integration into global value chains has improved markedly, rising from 32% in 2015 to 46% in 2024.

However, forward and two-sided linkages remain relatively weak. The sector is gradually shifting from final-goods exports toward multi-stage, modular production, driven by increased imports of intermediates and electric vehicle inputs.

According to the Trade Watch report, achieving deeper integration into global automotive value chains will require a strategic policy shift away from protectionism toward lower input tariffs, improved logistics, and stronger alignment with international standards.

Comprehensive Strategy

To enhance competitiveness and global positioning, the report emphasizes the need for India to adopt a comprehensive strategy that includes tariff rationalization, promotion of two-way trade, and greater participation in cross-border digital and manufacturing platforms.

Reorienting production toward high-demand segments such as passenger vehicles, strengthening quality standards and certification systems, and accelerating technology adoption will be critical to fostering stronger forward linkages in global supply chains. Combined with the strength of the domestic market, these measures can enable India to scale up high-quality production, diversify export markets, and secure a larger share of global automotive and services trade, as outlined in the report.

“India’s trade performance in Q1 FY26 reflects a steady consolidation, with services exports continuing to anchor external stability and provide a growing surplus. In contrast, merchandise export shows a gradual reorientation towards technology- and capital-intensive segments,” said Virmani.

“The growing prominence of electronics, machinery and chemicals signals structural shift in India’s export basket, even as traditional commodity- and labour-intensive sectors face global headwinds. The analysis of creative economy further highlights India’s emerging strength in skill-intensive, innovation-driven services, where it is already among the leading global players,” he added.

(Cover photo by Bernd 📷 Dittrich on Unsplash)