New Delhi: India’s digital payments ecosystem has witnessed impressive growth, driven by increased accessibility, user adoption, and a robust acceptance infrastructure. The continuing expansion of the unified payments interface (UPI), which has completely transformed digital payments in India, has brought about significant enhancements across various payment instruments, promoting a diversified and inclusive payments ecosystem.

Over the past two decades, India’s payment landscape has evolved from a paper-based, cash-dominant system to one of the most advanced and inclusive digital payment ecosystems globally. The bouquet of systems now spans traditional instruments such as cheques alongside modern platforms including NEFT, RTGS, IMPS, NACH, cards, prepaid instruments and the UPI. This transformation has been underpinned by strong policy support from the Reserve Bank of India and National Payments Corporation of India (NPCI), combined with greater availability of smartphones, internet penetration, and the rise of fintech innovations that have made digital transactions more accessible and affordable than ever before.

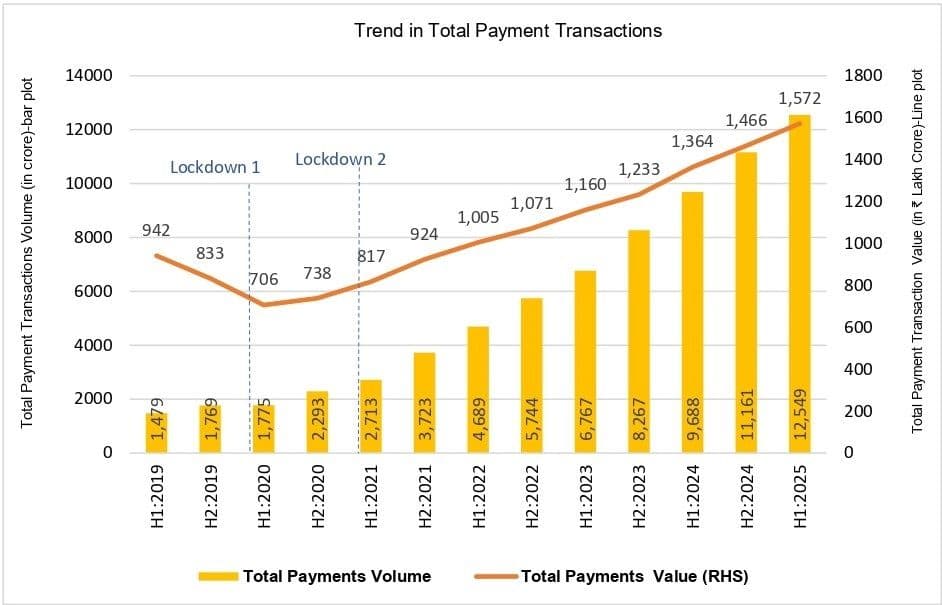

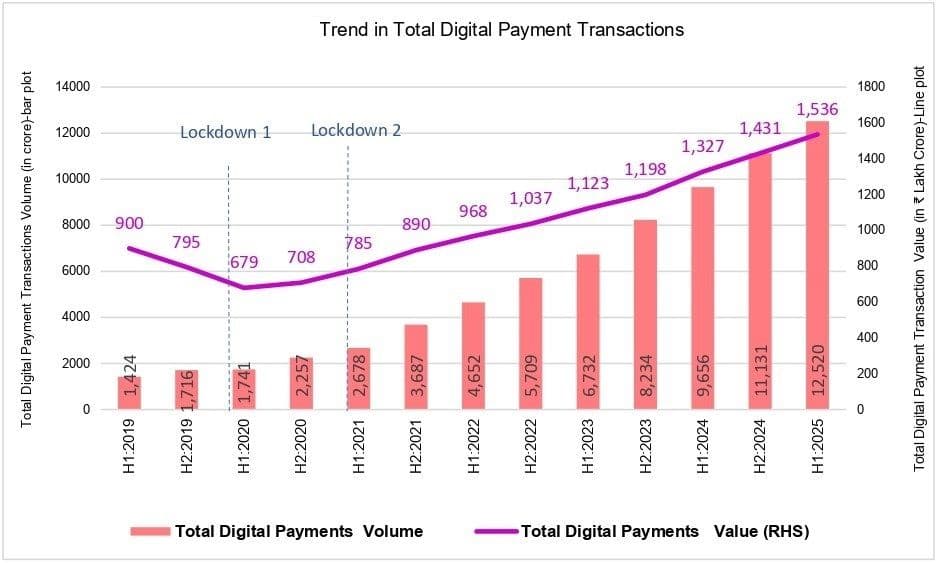

The RBI’s second edition of the half-yearly Payment Systems Report for June 2025, states that in 2019, India recorded 3,248 crore payment transactions valued at ₹1,775 lakh crore. By 2024, the number of transactions had surged more than six-fold to 20,849 crore, with value increasing to ₹2,83,010 lakh crore. The momentum continued into the first half of 2025, when the country recorded 12,549 crore transactions amounting to ₹1,57,200 lakh crore.

Digital payments now overwhelmingly dominate India’s transaction landscape, accounting for 99.8% of the total by volume and 97.7% by value in the first half of 2025, compared with 96.7% and 95.5% respectively in 2019. This remarkable shift reflects a structural change in consumer behaviour, where digital has become the default mode of payment across all segments of society.

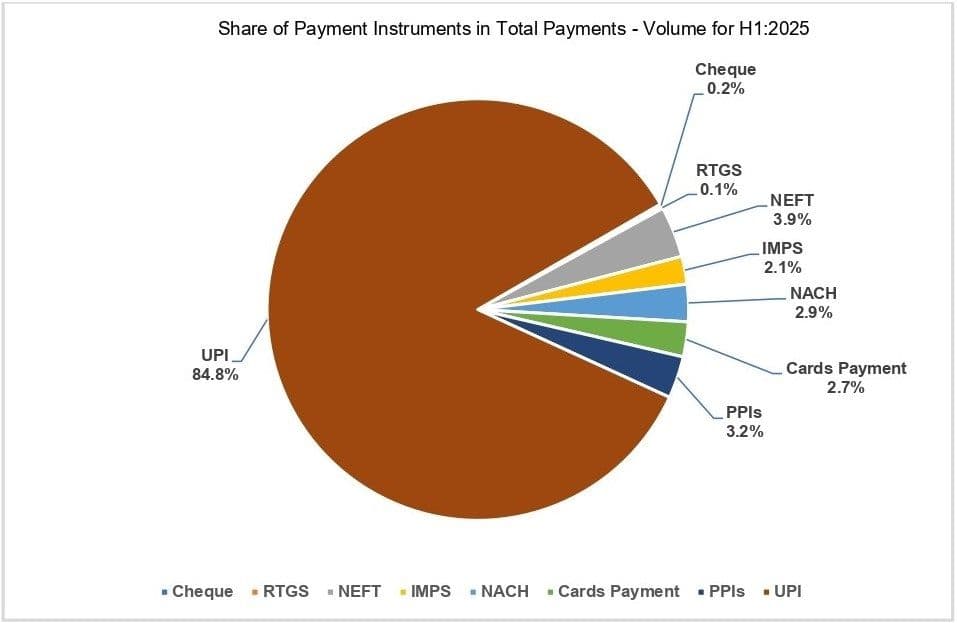

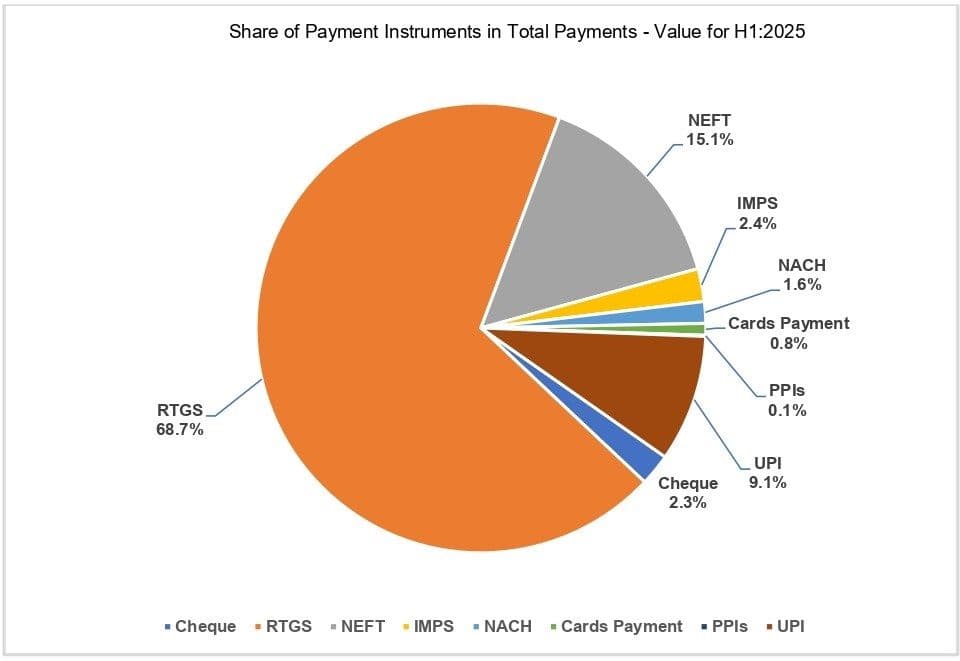

UPI Drives Volume; RTGS Leads Value

At the centre of this transformation is the all-popular UPI, which has revolutionised retail payments in India with its ease of use, interoperability, and real-time settlement. UPI’s growth has been exponential: transaction volume jumped from 1,079 crore in 2019 to 17,221 crore in 2024, while transaction value surged from ₹18.4 lakh crore to ₹246.8 lakh crore. In just the first six months of 2025, UPI processed 10,637 crore transactions worth ₹143.3 lakh crore, already exceeding half of the previous year’s total. UPI now accounts for 85% of all payment transactions by volume, though it represents a more modest 9% share by value due to its focus on small-value transactions. Its popularity as a fast payment system for everyday transfers and merchant payments has solidified its place as the foundation of India’s digital economy.

In contrast, the real time gross settlement (RTGS) system, which caters to high-value wholesale transactions, dominates in terms of transaction value. RTGS volumes doubled from 14.8 crore in 2019 to 29.5 crore in 2024, while transaction value rose from ₹1,388.7 lakh crore to ₹1,938.2 lakh crore during the same period. In the first half of 2025, RTGS recorded 16.1 crore transactions amounting to ₹1,079.2 lakh crore, maintaining its lead in large-value settlements.

The system’s role as the backbone for inter-bank transfers and capital market settlements remains pivotal. Together, UPI and RTGS represent two poles of India’s payments ecosystem — one driving inclusion and transaction density, the other ensuring stability and liquidity in the financial system.

Beyond RTGS, systems operated by the Clearing Corporation of India Ltd (CCIL) for government securities, forex clearing and rupee derivatives have also registered substantial growth. CCIL transactions increased from 35 lakh in 2019 to 45 lakh in 2024, with transaction value more than doubling from ₹1,270 lakh crore to ₹2,780 lakh crore. In the first half of 2025 alone, CCIL recorded 28.8 lakh transactions worth ₹1,734 lakh crore. The G-Sec market alone processed ₹994 lakh crore during the same period, while forex clearing stood at ₹682 lakh crore and rupee derivatives at ₹58 lakh crore, reflecting the growing depth and maturity of India’s financial markets.

Broad-Based Growth

Parallel to the expansion of large-value systems, retail payment systems — covering everyday consumer and business transactions — have also grown remarkably. Retail transaction volume rose from 3,233 crore in 2019 to 20,820 crore in 2024, while transaction value more than doubled from ₹386 lakh crore to ₹892 lakh crore. The National Electronic Funds Transfer (NEFT) system, a long-standing retail payment workhorse, saw its volume more than triple from 262.2 crore transactions in 2019 to 926.8 crore in 2024, with value growing to ₹432.8 lakh crore. In the first half of 2025 alone, NEFT processed 490.5 crore transactions worth ₹237 lakh crore, demonstrating enduring relevance for both personal and business payments.

The immediate payment service (IMPS), another fast payment channel, has consolidated its role as a preferred option for medium-value transfers. Transaction volume more than doubled from 238.3 crore in 2019 to 593.8 crore in 2024, while transaction value rose from ₹21.8 lakh crore to ₹70.7 lakh crore.

During the first half of 2025, IMPS handled 267.2 crore transactions worth ₹37.1 lakh crore. With an upper limit of ₹5 lakh per transaction, IMPS continues to complement UPI by serving higher-value needs across both individuals and small businesses.

The national automated clearing house (NACH), which facilitates bulk payments and collections, has also seen sustained growth. From 324.7 crore transactions worth ₹16.6 lakh crore in 2019, NACH scaled to 677.1 crore transactions valued at ₹42.2 lakh crore in 2024. In the first half of 2025, the system processed 358.8 crore transactions amounting to ₹24.47 lakh crore, supported largely by direct benefit transfers (DBT), salary credits, and recurring bill payments.

The Bharat Bill Payment System (BBPS), meanwhile, has transformed India’s bill payments landscape. Its transaction volume increased from 12.6 crore in 2019 to 217.5 crore in 2024, while value surged from ₹0.2 lakh crore to ₹7.7 lakh crore. In just six months of 2025, BBPS recorded 149 crore transactions worth ₹6.95 lakh crore, reflecting its increasing role in digitising routine utility payments. The number of billers on the platform grew dramatically—from just 134 in June 2019 to 22,378 by June 2025.

The National Electronic Toll Collection (NETC) system, powered by RFID-based FASTag technology, has digitalised highway toll payments at scale. NETC transaction volume expanded from 25.6 lakh in 2019 to 16.2 crore in 2024, while transaction value rose from ₹72.6 crore to ₹2,425 crore. In the first half of 2025, it processed 8.8 crore transactions worth ₹1,128.98 crore, aided by the increase in onboarded toll plazas from 505 in 2019 to 1,782 in 2025 and FASTag issuance growing from 52 lakh to 11.11 crore.

Likewise, the Aadhaar-enabled Payment System (AePS) continues to advance financial inclusion, particularly in rural areas. Transaction volume rose from 92.6 lakh in 2019 to 239.7 lakh in 2024, while transaction value grew from ₹1,610 crore to ₹7,102 crore. During the first half of 2025, AePS recorded 108 lakh transactions amounting to ₹3,545 crore, confirming its role in facilitating last-mile digital banking.

Cards and Prepaid Instruments

While India’s card base continues to expand, usage trends reveal shifting consumer preferences. As of June 2025, there were 111.64 crore outstanding cards, including 11.12 crore credit cards and 100.52 crore debit cards. Credit card transactions increased sharply from 208.7 crore in 2019 to 447.2 crore in 2024, while value surged from ₹7.1 lakh crore to ₹20.4 lakh crore.

In the first half of 2025, 266.3 crore transactions worth ₹11.1 lakh crore were recorded. Private sector banks strengthened their dominance, expanding their share from 65.8% in June 2020 to 70.8% in June 2025, while public sector banks also gained modestly to 24.1%. Foreign banks, in contrast, saw their market share contract to 4.1% as their outstanding cards declined from 67 lakh to 45 lakh.

Debit cards, though more widely held, have witnessed a decline in usage amid UPI’s widespread adoption. Transaction volume fell from 495.3 crore in 2019 to 173.8 crore in 2024, while transaction value decreased from ₹6.83 lakh crore to ₹5.15 lakh crore. In the first half of 2025, debit card transactions stood at 69.09 crore, amounting to ₹2.22 lakh crore.

Public sector banks still dominate this segment with a 63.5 per cent share, but their lead has narrowed as private sector banks and small finance banks expanded their footprint. The growing preference for mobile-based payments has clearly diverted transactional use away from debit cards.

Prepaid payment instruments (PPIs) — including mobile wallets and prepaid cards — have played a complementary role but face similar competitive pressures. Transaction volume rose from 516.2 crore in 2019 to 698.9 crore in 2024, while transaction value remained nearly constant at ₹2.23 lakh crore. In the first half of 2025, PPIs recorded 404.7 crore transactions worth ₹1.23 lakh crore.

However, overall issuance fell from 190 crore wallets and cards in June 2020 to 135.2 crore in June 2025, reflecting the consolidation of digital spending within interoperable systems such as UPI and linked bank accounts.

The payments ecosystem in India has thus evolved into a vast, multi-layered digital architecture. UPI continues to drive the surge in transaction volumes, RTGS and CCIL systems anchor large-value settlements, while retail payment systems such as NEFT, IMPS, NACH, and BBPS ensure inclusivity and reach.

The gradual decline of paper instruments and the growing ubiquity of digital interfaces reflect a decisive shift toward a cash-lite economy. As India’s digital economy deepens, the next phase of growth will hinge on expanding cross-border payment linkages, enhancing cybersecurity, and strengthening the resilience of the digital infrastructure. The story of India’s payment systems, built on innovation, accessibility, and scale, is increasingly becoming a global benchmark for inclusive financial transformation.