Photo courtesy: PickPic

New Delhi: India’s energy story is accelerating on multiple fronts — demand growth, renewable expansion and policy ambition.

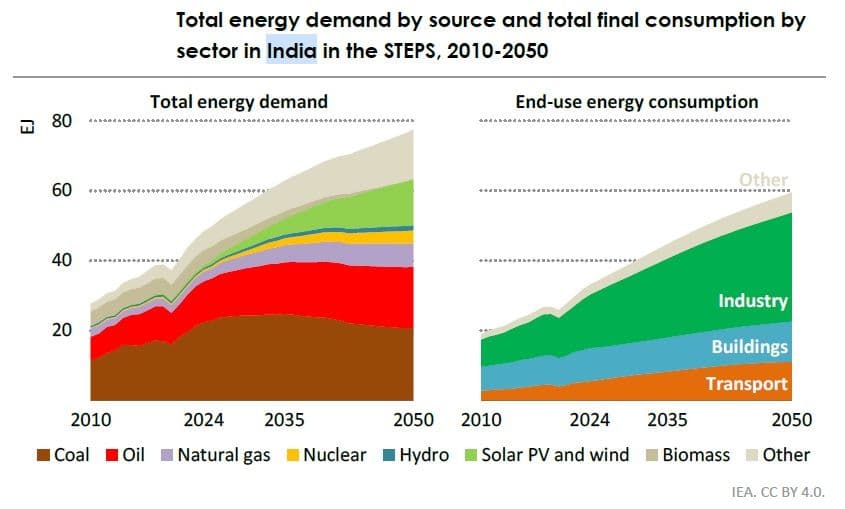

According to the International Energy Agency’s (IEA) latest outlook, India is now the largest source of global energy demand growth, adding over 15 exajoules (EJ) by 2035 under the Stated Policies Scenario (STEPS), nearly as much as the combined growth of China and all Southeast Asian economies.

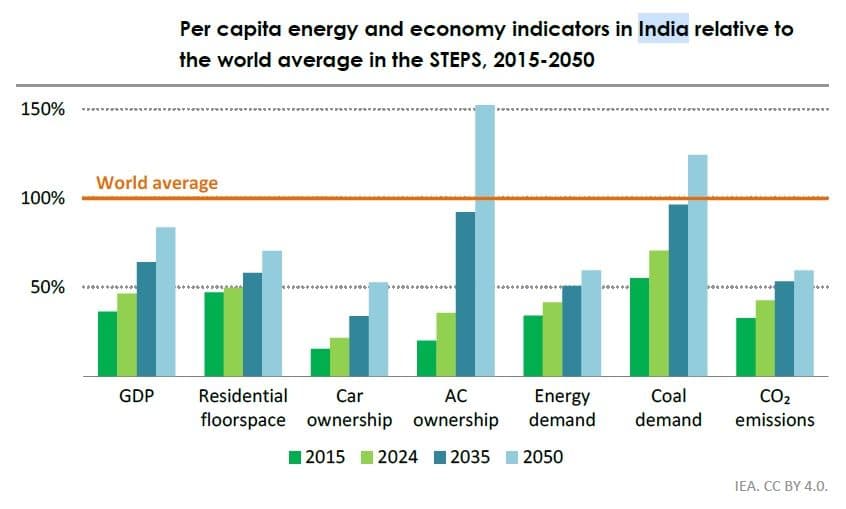

Behind this surge lies the country’s robust economic momentum. Between 2010 and 2024, India’s GDP grew faster than any major economy except China. Through 2035, it is expected to expand by an average 6.1% annually, the highest in the world. By that year, India’s per capita GDP is projected to be 75% higher than today, reflecting a rapid shift towards middle-income consumption patterns.

Urbanisation and Rising Demand

This economic transformation is reshaping India’s energy landscape. The country adds the equivalent of one Bengaluru every year to its urban population, while built floor space is set to expand by 40% by 2035. Each day, around 12,000 new cars join Indian roads, and over the next decade, more than 250 million air conditioners will be added to homes.

These trends have pushed energy demand higher across all sectors, especially industry and transport, which together account for most of the projected increase. The industrial sector alone contributes over half of total demand growth to 2050, underlining the energy intensity of India’s manufacturing-led development model.

Balancing Growth with Green Goals

India’s challenge is twofold: fuelling this growth while pursuing its “net zero by 2070” commitment. The country’s policy mix reflects this balancing act — from expanding clean capacity to strengthening supply reliability and curbing emissions.

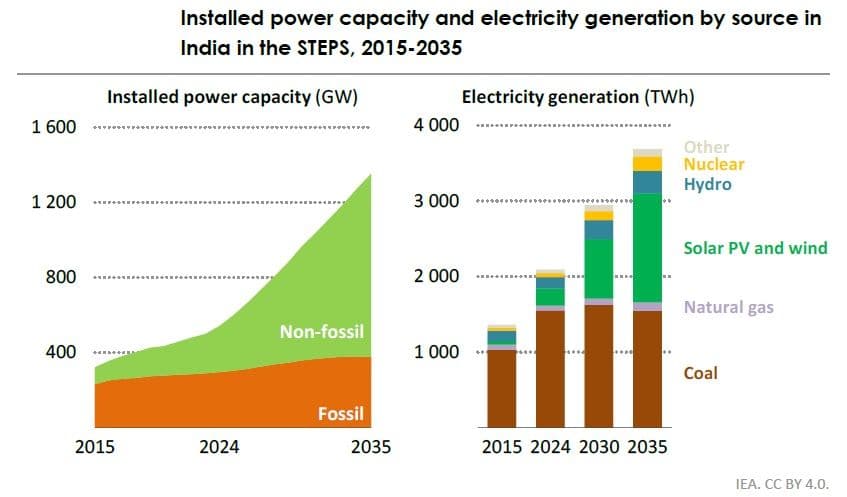

India has already achieved one of its flagship renewable milestones five years ahead of schedule. The government’s target of raising non-fossil power capacity to 50% by 2030 was reached in 2025 for grid-connected systems, and will be achieved in 2026 even when auto-producers are included, according to the IEA.

Investment Shifts and the Rise of Solar

The turnaround in investment flows is striking. In 2015, for every dollar invested in fossil-fuel-based power generation, roughly one dollar went into non-fossil sources — a 1:1 ratio. “By 2025, this ratio had increased to 1:4 in favour of non-fossil sources. Solar PV alone has attracted $113 billion in cumulative investment in the past decade, compared with $112 billion for all fossil fuel power generation sources combined,” the report says.

India’s renewables push is now one of the fastest and largest globally, aided by lower technology costs, government incentives, and strong investor interest.

Under STEPS, the share of non-fossil sources in installed capacity is expected to rise to 60% by 2030 and 70% by 2035, accounting for over 95% of all capacity additions. This marks a complete reversal from the 2015-24 period, when coal and gas together made up over 70% of incremental generation.

Coal Persists, but Cleaner Grid Ahead

Despite rapid progress, coal remains a mainstay of India’s power mix, especially as a source of dispatchable generation and grid stability. Industrial coal demand continues to rise moderately to 2035.

Yet the overall grid is turning greener. Solar and wind together are projected to lift their share in generation from 11% today to 25% by 2030, and nearly 40% by 2035. Nuclear power, too, is set to triple its output by then. Consequently, non-fossil sources will account for more than half of all electricity generation by 2035, cutting the carbon intensity of power by 45%, to about 400 gCO₂ per kilowatt-hour, narrowing the gap with the global average.

These changes also bring tangible co-benefits: a sharp decline in emissions of fine particulate matter and sulphur dioxide, easing India’s chronic air pollution problem.

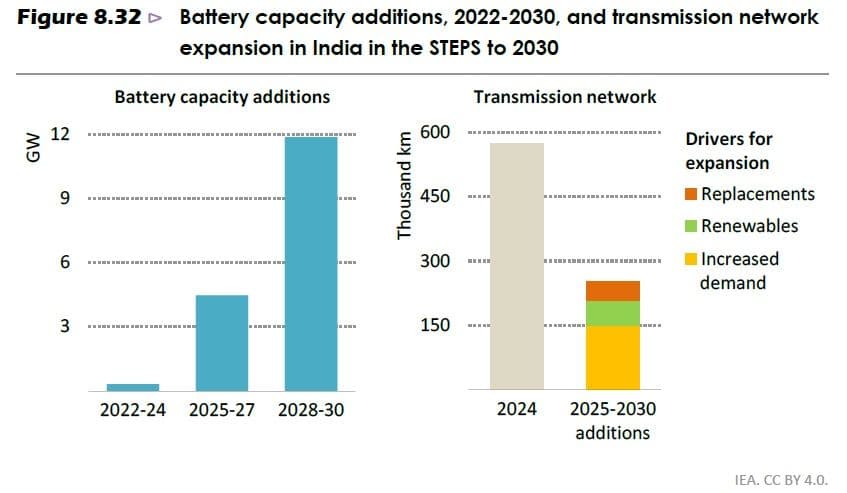

The Infrastructure Imperative

The clean energy transition also demands massive investment in grid infrastructure and energy storage. By 2030, India is expected to add over 230 gigawatt-hours (GWh) of battery storage capacity, while expanding its transmission network by 35%, with over 200,000 km of new transmission lines, including nearly 60,000 km dedicated to renewable integration. The Green Energy Corridor initiative is central to this effort, facilitating the flow of renewable power across states.

Financial Strain and Reform Push

However, the financial health of state distribution companies (discoms) remains a major risk. “India faces challenges arising from the financial weakness of distribution companies, exemplified by delayed payments to generation companies totalling $7 billion in October

2025,” the IEA report says. To address this, the government has implemented a series of reforms, including a payment security mechanism, a dedicated fund and state-backed guarantees, aimed at restoring investor confidence.

These steps appear to be yielding results. The share of foreign direct investment (FDI) in the power sector has doubled compared with the 2015-20 average, now accounting for nearly 10% of total power investment.

Long-Term Roadmap

India’s broader energy strategy extends beyond renewables. The country aims to scale up nuclear capacity to 100 GW by 2047 from just 8 GW today, launch a carbon market in 2026 for select industries, and sustain a 20% ethanol blending rate in gasoline to curb oil imports.

Even as fossil fuels retain a foothold, particularly in heavy industry and freight transport, the direction of travel is clear: India’s energy mix is diversifying rapidly. In the STEPS outlook, the country’s CO₂ emissions peak around 2040, then stabilise at about 3.4 gigatonnes per year by 2050.

Defining Role in Global Energy

With energy demand growth surpassing every other major economy, India’s trajectory will shape the global energy balance in the coming decades. Its early achievement of the non-fossil capacity target underscores how policy consistency, investment appetite, and scale can converge to drive systemic change.

The next phase of India’s transition — strengthening grids, ensuring discom solvency, and managing industrial coal dependence — will determine whether the country can sustain this momentum. If it succeeds, India will not just be the fastest-growing energy market, but also a model for balancing growth with decarbonisation in the developing world.