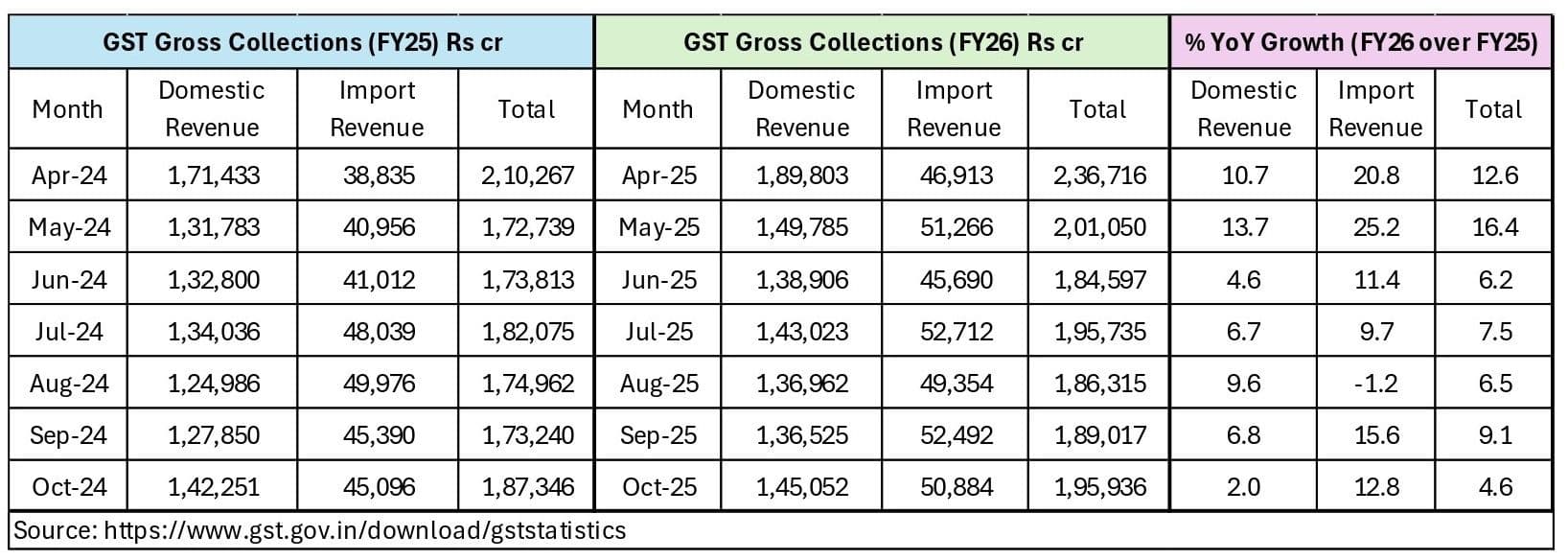

New Delhi: Gross GST collections for October (representing returns for September filed in October) stood at ₹1.96 lakh crore, marking a 4.6% year-on-year increase. The gross domestic collection grew by 2%, while the gross import revenue rose by 12.8% during the same period.

E-way bills generated in September reached an all-time high of 13.2 crore, indicating strong transactional activity.

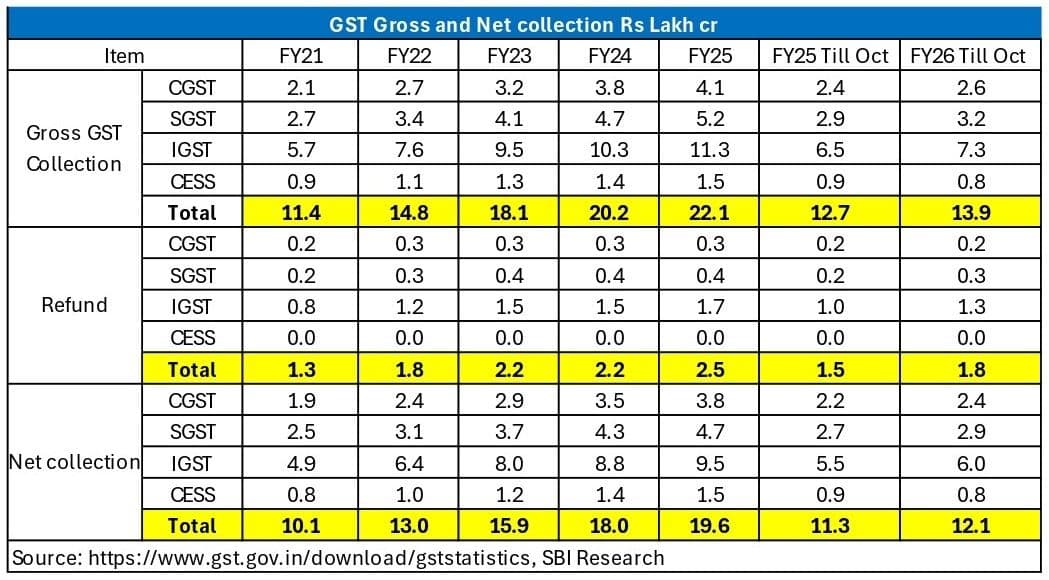

Total GST refunds for October amounted to ₹26,934 crore, registering a 39.6% YoY growth. Cumulatively, refunds for the April-October period stood at ₹1.8 lakh crore, a 23.9% increase over the corresponding period last year. Refunds have shown consistent growth over the years, increasing from ₹1.3 lakh crore in FY21 to ₹2.5 lakh crore in FY25.

At the state level, most regions reported gains in GST revenue compared to October last year. Karnataka recorded a 10% increase, despite having earlier estimated a monthly decline of ₹7,083 crore. Punjab and Telangana posted gains of 4% and 10%, respectively. West Bengal saw a marginal 1% decline, while Kerala recorded a 2% decline.

According to an SBI research paper, based on the October 2025 trends, projections for FY26 indicate that most states will continue to post gains following GST rate rationalization. Maharashtra is projected to gain 6%, while Karnataka’s gain is estimated at 10.7%, keeping overall GST collections above the budgeted estimates for the fiscal year.

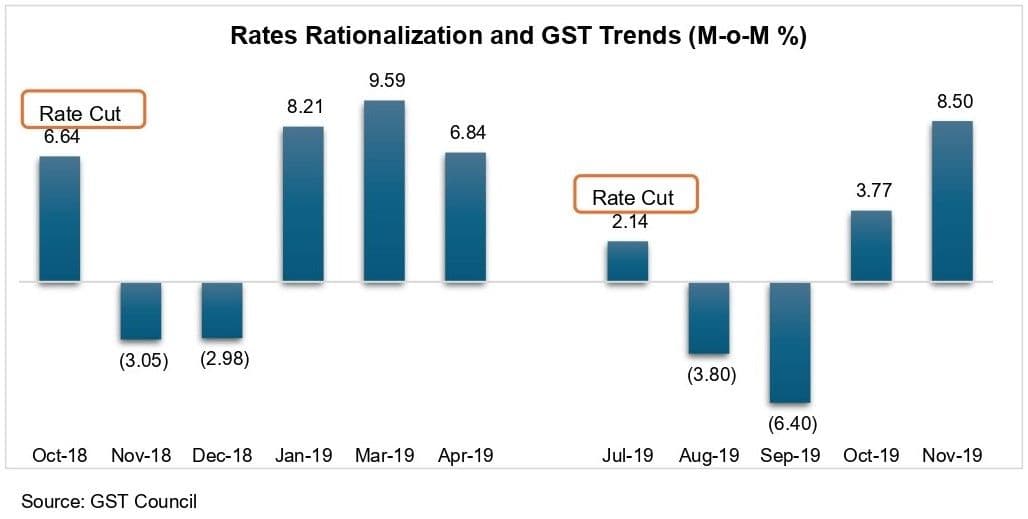

Historical data from earlier rounds of GST rate changes in July 2018 and October 2019 show that while rate adjustments typically lead to a short-term 3-4% month-on-month dip, collections usually rebound with 5-6% monthly growth, translating into additional revenues of nearly ₹1 trillion in subsequent periods.