New Delhi: The government has tightened the Mineral (Auction) Rules, 2015, ushering in tough intermediary timelines, monetary penalties for delays, and incentives for early production — a sweeping reform designed to break the long-standing logjam in operationalising auctioned mines and accelerate India’s mineral output.

Notified on October 17 by the Ministry of Mines, the amendment mandates time-bound milestones between the issuance of the letter of intent (LoI) and the execution of mining leases, addressing a chronic gap that allowed awarded mineral blocks to remain idle for years.

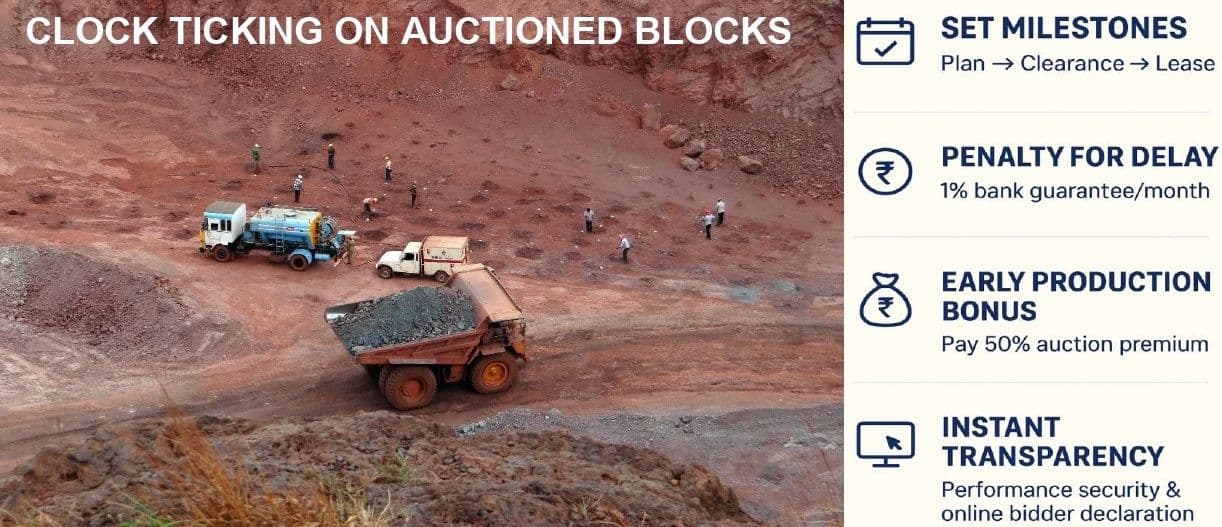

For the first time, the rules prescribe defined stages for mine development — from approval of the mining plan within six months, to securing environmental clearance within 18 months, and executing the mining lease within the following 12 months. Any delay will now attract a penalty of 1% of the bidder’s bank guarantee per month, while early production will be rewarded with a 50% reduction in auction premium for output achieved within five years of the LoI in the case of mining leases (and seven years for composite licences).

The reform also tightens financial discipline by requiring bidders to furnish performance security before the LoI is issued, instead of several years later. State governments, too, will face accountability — failure to issue LoIs within 30 days of receiving payments and security will trigger a 5% monthly reduction in the second instalment of upfront payment due to the state.

By introducing these measures, the ministry aims to dismantle speculative holding of mineral rights and push mines toward faster production. The new rules apply not only to fresh auctions but also retrospectively to blocks already auctioned, compelling preferred bidders to submit performance security within six months and adhere to pending milestones.

Since the auction regime’s inception in 2015, 585 major mineral blocks — including 34 critical minerals — have been successfully auctioned, with over 100 blocks awarded annually in recent years. Yet, operationalisation lagged behind due to weak monitoring and a lack of interim checks. The latest amendment directly targets that gap by institutionalising milestone-based tracking and linking penalties and incentives to performance outcomes.

A state-level committee headed by the director of mines and geology, with representation from the revenue, forest and environment departments and the Indian Bureau of Mines, will decide on cases of delay, ensuring penalties are imposed only when bidders are at fault. Preferred bidders will now be declared instantly on the e-auction platform, with results made publicly viewable — a move expected to enhance transparency and investor confidence.

The ministry has complemented these changes with a project monitoring unit (PMU) to oversee mine development and regular review meetings with states and bidders. Officials said the intent is not to punish but to ensure accountability and efficiency, turning awarded mineral blocks into producing assets within defined timelines.

By combining strict compliance with clear rewards for performance, the government hopes to inject momentum into India’s mining ecosystem, boost domestic mineral output, and strengthen the country’s position in the global race for critical resources essential to manufacturing and clean energy.