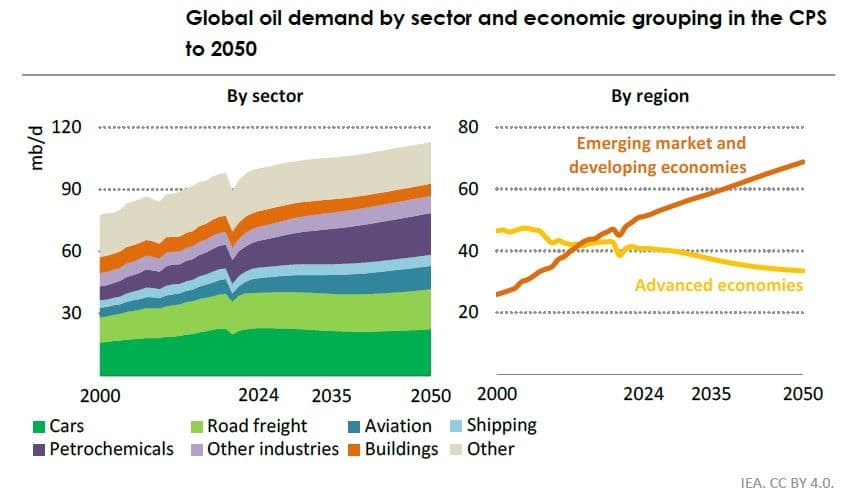

New Delhi: Global demand for oil is on track to reach an all-time high of 113 million barrels per day by 2050, driven largely by emerging market growth and limited progress on energy transition policies, according to new projections made under the Current Policies Scenario (CPS), which assumes no major changes to today’s government energy or climate measures.

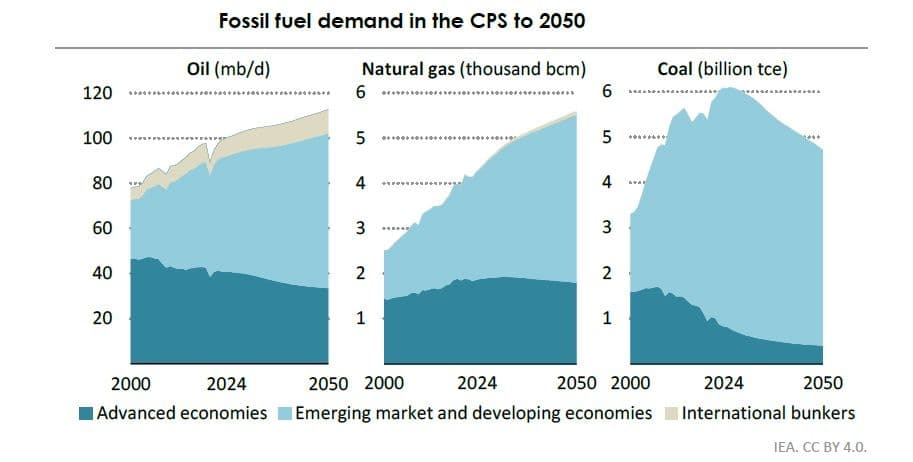

The International Energy Agency’s World Energy Outlook 2025 released Wednesday also suggests that without stronger climate and energy measures, oil and gas will continue to dominate the global energy mix for decades. The CPS assumes existing policies remain in place and finds total final energy consumption rising by about 1.3% annually to 2035 — matching the pace of the past decade — as industrial output, transport demand, and appliance ownership expand worldwide.

Emerging Economies Drive Oil Growth

Oil demand growth comes mainly from developing economies, where use for road transport, petrochemical feedstock, and aviation continues to rise. While electric vehicle (EV) adoption slows in most regions lacking strong incentives, China and Europe remain key exceptions, sustaining the momentum in EV sales.

On the supply side, oil and gas prices are expected to trend upward through 2050. The United States remains the world’s largest producer, while OPEC+ output is projected to stand 15% higher than any point in history by mid-century. The outlook assumes a gradual easing of sanctions-related production constraints in some countries; if these persist, compensating supply elsewhere would require additional investment and could push prices even higher.

Natural Gas Expansion Led by Asia

Global natural gas demand is forecast to climb to 5,600 billion cubic metres by 2050, with Asia’s developing economies accounting for the largest share of growth. New pipeline connections from Russia to China and expanded liquefied natural gas (LNG) trade are expected to meet much of this rising demand. Strong consumption growth is also seen in the Middle East.

Power Sector: Slow Electrification, Persistent Coal

Electricity demand increases across all regions, led by India and Indonesia, but the shift toward widespread electrification remains limited under current policies. Solar and wind power are competitive on cost but face grid integration challenges that constrain faster growth. Annual solar photovoltaic (PV) installations average around 540 gigawatts to 2035, roughly steady with 2024 levels.

Coal remains the single largest source of global power generation for at least another decade, while nuclear power construction gains momentum in the 2030s. Global electricity networks expand rapidly, with grid length rising by 25 million kilometres by 2035 — a 30% increase — and another 40 million kilometres by 2050.

Emissions and Climate Implications

Under the CPS, global energy-related CO₂ emissions rise slightly and stabilize near 40 gigatonnes annually through 2050. Emissions fall in advanced economies and in China after 2030, but continue to rise across much of the developing world.

Total greenhouse gas output under this trajectory would drive a 2°C increase in average global temperature by 2050, reaching roughly 2.9°C by 2100 — far above international climate targets.