Photo: Freepik

Among key trading partners, the UAE, Spain, China, Bangladesh and Egypt recorded robust year-on-year growth in exports during September

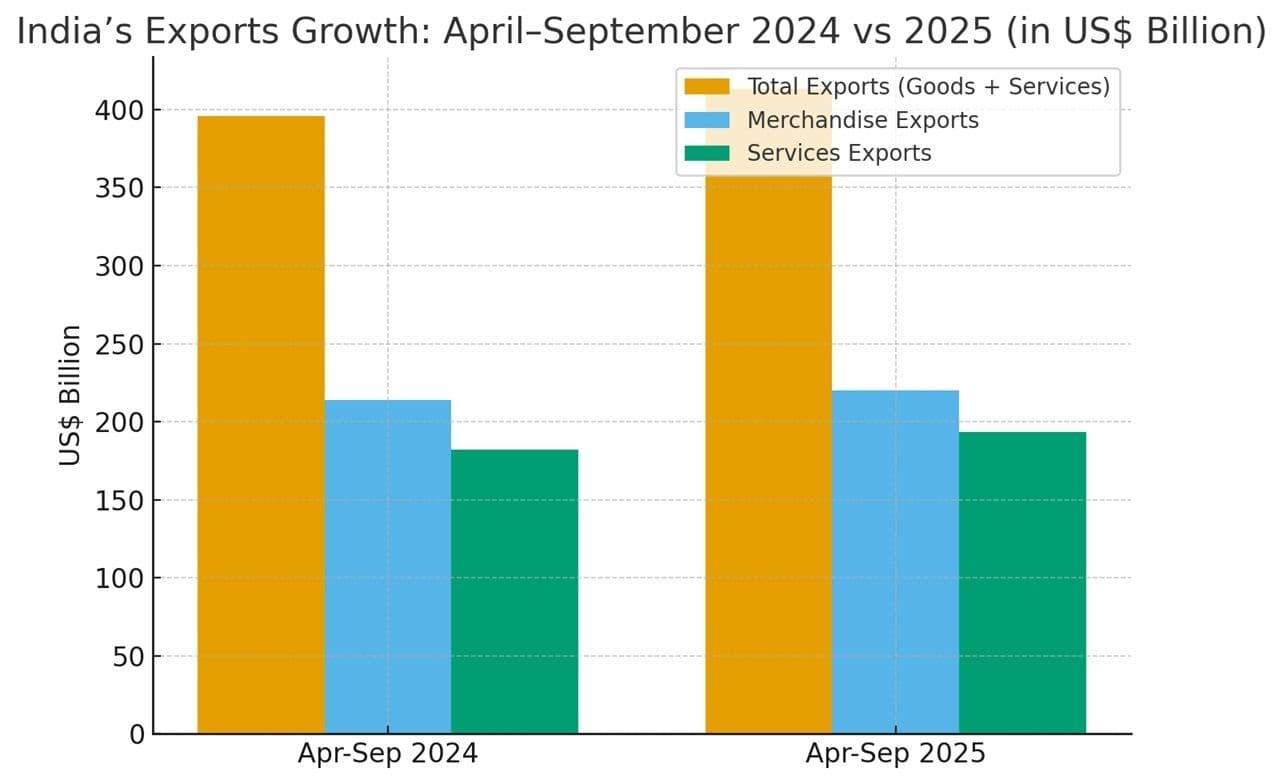

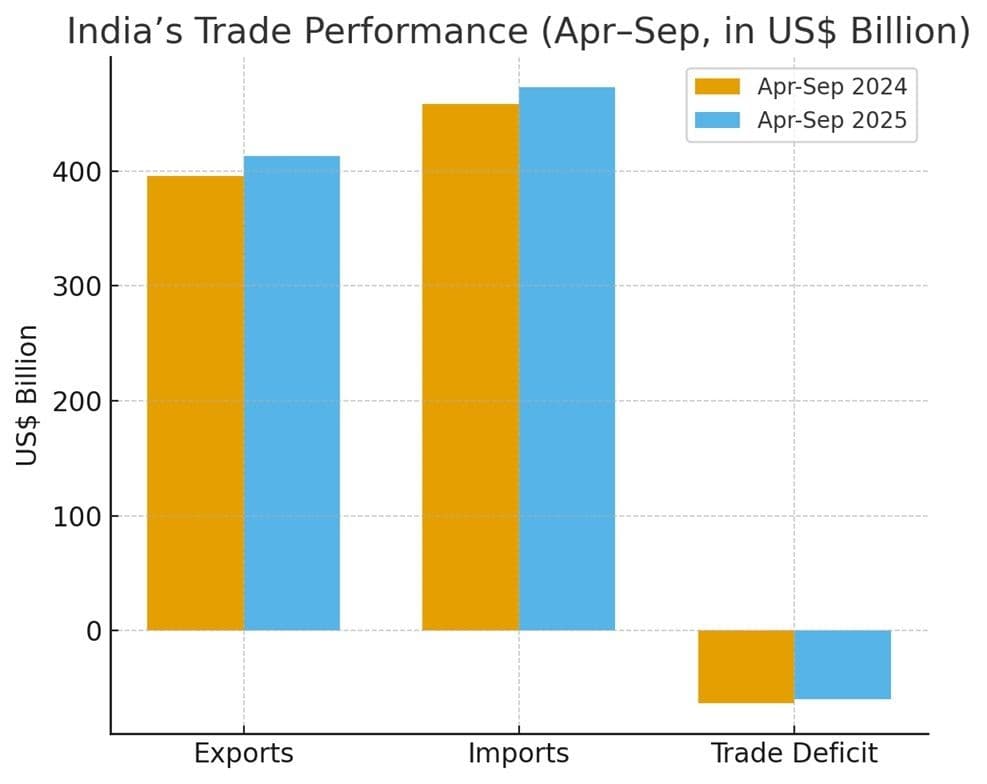

New Delhi: India’s external trade maintained steady growth in the first half of FY26, with total exports of goods and services rising 4.45%year-on-year to $413.3 billion, according to provisional data released by the Ministry of Commerce. The gains came even as the IMF raised India’s 2025 GDP growth forecast to 6.6%, citing resilient domestic demand and robust first-quarter performance.

Merchandise exports during April-September 2025 stood at $220.12 billion, up 3.02% from a year earlier. Services exports, which remain India’s key strength, grew 6.12%to $193.18 billion. Imports during the six-month period rose 3.55%to $472.79 billion, widening the merchandise trade deficit to $154.98 billion, compared to $145.18 billion a year ago.

Non-petroleum exports during April-September touched $189.49 billion, marking a healthy 7.04% increase, while non-petroleum, non-gems and jewellery exports were $175.29 billion, up from $163.09 billion in the corresponding period last year. The services trade surplus for the first half of FY26 widened to $95.5 billion, against $84.31 billion in the previous year, offsetting part of the merchandise deficit.

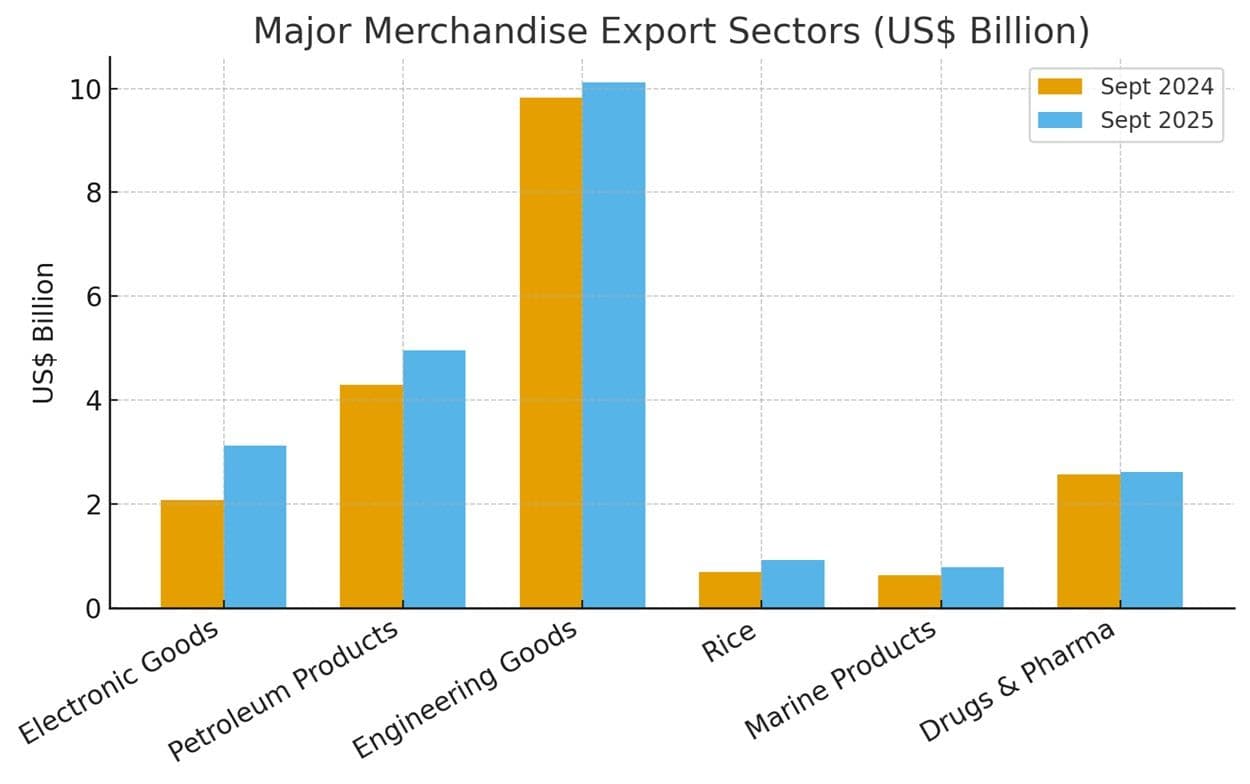

Export growth was driven by sectors such as electronics, petroleum, engineering goods, rice, marine products and pharmaceuticals, reflecting both manufacturing resilience and global demand revival. Electronics exports surged 50.54% to $3.12 billion in September 2025, underlining the impact of the government’s production-linked incentive (PLI) schemes. Petroleum product exports rose 15.22%to $4.96 billion, engineering goods shipments grew 2.93%to $10.11 billion, while rice and marine products recorded strong gains of 33.18%and 23.44%, respectively.

In September 2025 alone, total exports (goods and services) were estimated at $67.20 billion, up 0.78% from a year earlier. Merchandise exports rose to $36.38 billion from $34.08 billion, while imports jumped to $68.53 billion, reflecting strong domestic demand and higher energy costs. Services exports were slightly lower at $30.82 billion, compared to $32.6 billion a year ago, but imports declined as well, keeping the overall surplus stable.

Among key trading partners, the UAE, Spain, China, Bangladesh and Egypt recorded robust year-on-year growth in exports during September. Over the six-month period, exports to the United States, UAE, China, Spain and Hong Kong rose sharply, highlighting India’s market diversification. Imports grew the most from Switzerland, UAE, China, Saudi Arabia and Nigeria, with Nigeria’s inbound shipments surging nearly ninefold on higher oil purchases.

IMF Outlook: Positive

The IMF’s October 2025 World Economic Outlook painted a positive picture for India, revising the country’s GDP growth for 2025 to 6.6%, up from 6.3% projected in July. Growth for 2026 is pegged at 6.2%, reflecting medium-term stability. The IMF said India’s growth trajectory remained largely unaffected by the recent rise in US tariffs on Indian imports, with domestic consumption and services exports offsetting external headwinds.

Trade experts said India’s export performance reflects a balanced but cautious recovery amid global uncertainties. “The consistent rise in non-petroleum exports and the widening services surplus are encouraging signs,” said a senior economist at a leading policy think tank. “However, the expanding merchandise deficit suggests that manufacturing competitiveness and value addition must remain policy priorities.”

The Department of Commerce said it would continue engaging with exporters, industry bodies and state agencies to sustain the current growth momentum through product diversification, technology upgrading and targeted market access efforts.

With festive-season demand and global restocking likely to support shipments in the coming months, analysts expect India’s export growth to remain on course. Yet, elevated energy prices and geopolitical uncertainty could pose near-term challenges, particularly on the import front.

Despite these risks, India’s first-half trade data and the IMF’s upgraded growth outlook together underscore a broader message: the world’s fifth-largest economy continues to stand out as a driver of global growth, even amid a turbulent trade environment.