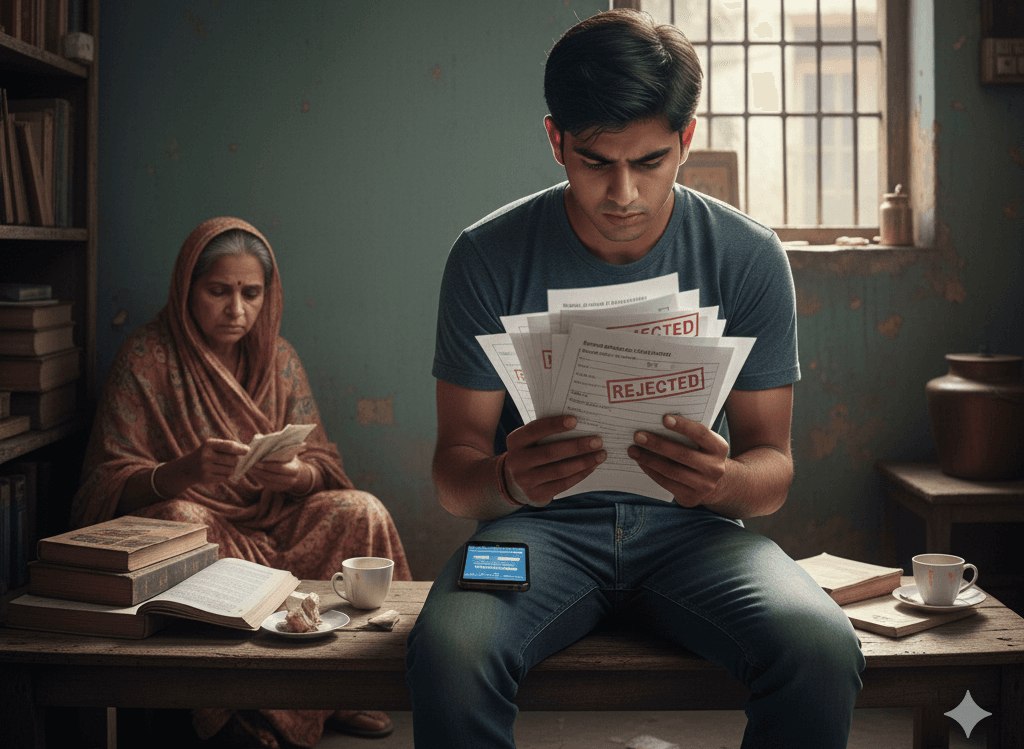

New Delhi: India’s education loan framework is facing a deepening crisis, with a Parliamentary Standing Committee warning that soaring higher-education costs and shrinking access to credit are leaving students increasingly vulnerable.

In a comprehensive review tabled in Parliament on Tuesday, the Committee on Education, Women, Children, Youth and Sports, chaired by Digvijaya Singh, flagged a sharp fall in the number of active education loans even as the overall borrowing amount has more than doubled between 2014 and 2025. This contrast reveals that fewer students are able to secure loans, and those who do must borrow far larger sums to keep pace with rising fees, the panel observed.

The committee noted that active student loans declined from 23.36 lakh to 20.63 lakh over the decade, while the total outstanding loan volume jumped from ₹52,327 crore to ₹1,37,474 crore. It expressed concern that such trends point to declining accessibility at a time when higher education has become significantly more expensive.

The panel urged the Department of Higher Education and the Department of Financial Services to expand loan sanctions, particularly to students from Below Poverty Line (BPL) households, warning that continuing the current approach risked excluding many deserving candidates.

Structural Reform Needed

Calling for structural reform, the panel recommended the urgent adoption of income-contingent repayment systems to shield graduates from job-market volatility and limit the growth of non-performing assets (NPAs) for banks. It also proposed extending the loan repayment moratorium to two years after course completion.

Stressing that education loans cannot be treated as a profit-driven activity in a welfare-oriented system, the committee pushed for a uniform national policy that sets reasonable interest rates and curbs wide variations in lending practices across banks.

Highlighting practical hurdles, the panel recommended raising the guarantee limit under the Credit Guarantee Fund Scheme for Education Loans from ₹7.5 lakh to ₹20 lakh and ensuring collateral-free loans up to ₹8 lakh. It asked financial institutions to exempt students from poor households — particularly those receiving free rations — from CIBIL or credit-history requirements, arguing that rigid eligibility norms often prevent economically weaker applicants from entering the loan system. It further suggested using ration cards as the primary eligibility criterion to simplify and standardize assessments.

The parliamentary panel has urged the Department of Higher Education and the Department of Financial Services to expand loan sanctions, particularly to students from BPL households.

Low Disbursement Rate

The committee also criticised the limited reach and sluggish implementation of key schemes such as the PM Vidyalaxmi portal, where only about 15% of sanctioned funds have been disbursed. With just 902 institutions currently covered under the scheme’s Quality Higher Education Institutions list, it urged the government to expand coverage and introduce district-level dashboards to ensure transparency in sanctioning and disbursement.

A separate section of the report raised alarms about persistent regional disparities, noting that Tamil Nadu, Kerala and Maharashtra continue to dominate loan uptake while northern and rural regions remain underserved. Despite digital portals, students across large parts of the country still face slow processing, demands for extensive documentation and pressure to produce guarantors—conditions that contradict the promise of easy, collateral-free access.

The panel also underscored the emotional and psychological toll of mounting student debt, observing that repayment pressure from lenders, families and society has, in extreme cases, led to severe distress.

It warned that without simplified procedures, strict enforcement of collateral-free rules, expanded interest subsidies and targeted awareness campaigns, education loans will continue to fall short of their purpose — risking the entrenchment of inequality rather than enabling equal opportunity in higher education.