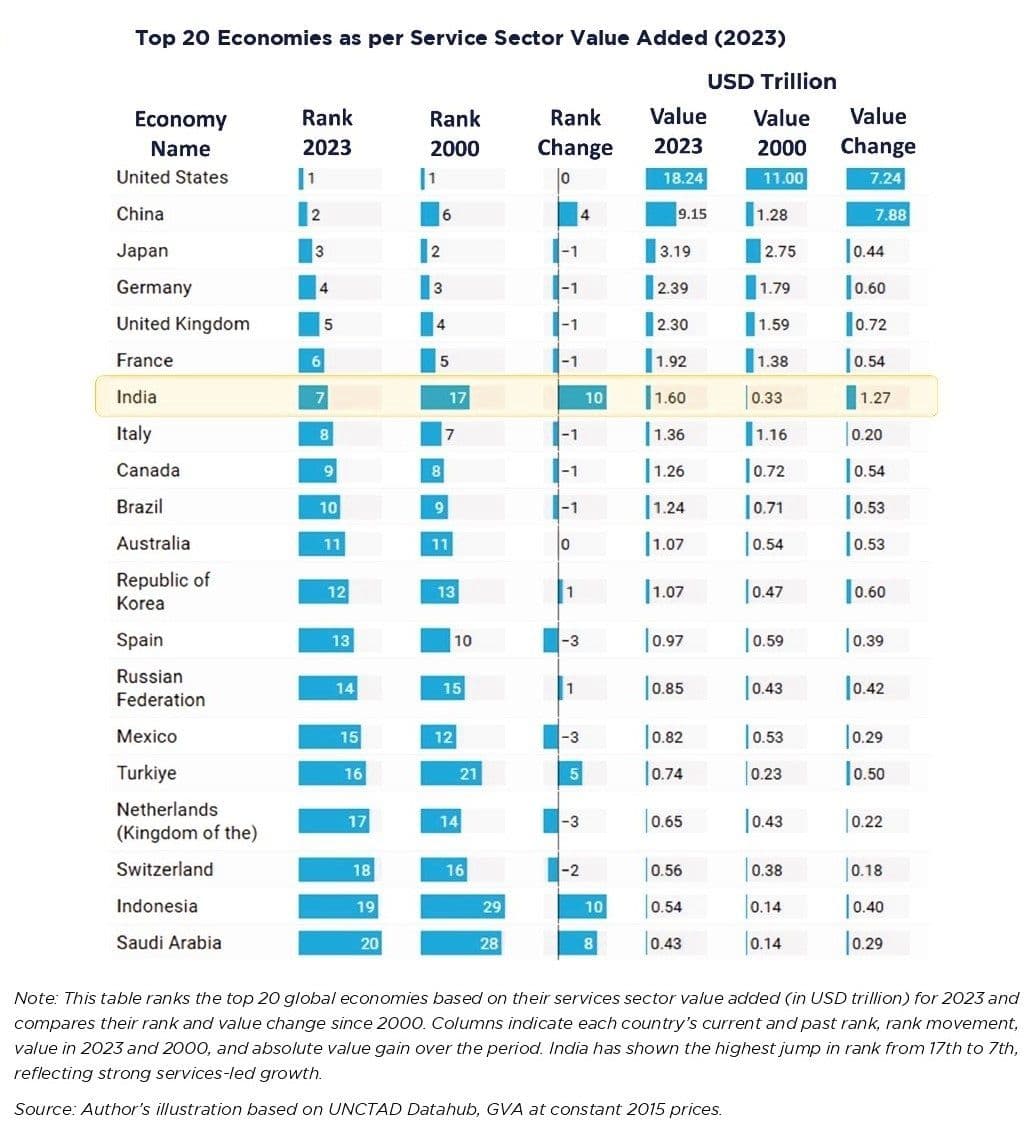

New Delhi: Diverging from the traditional path of agriculture-industry-services, India’s economy has charted a distinctive course: one led by its dynamic services sector.

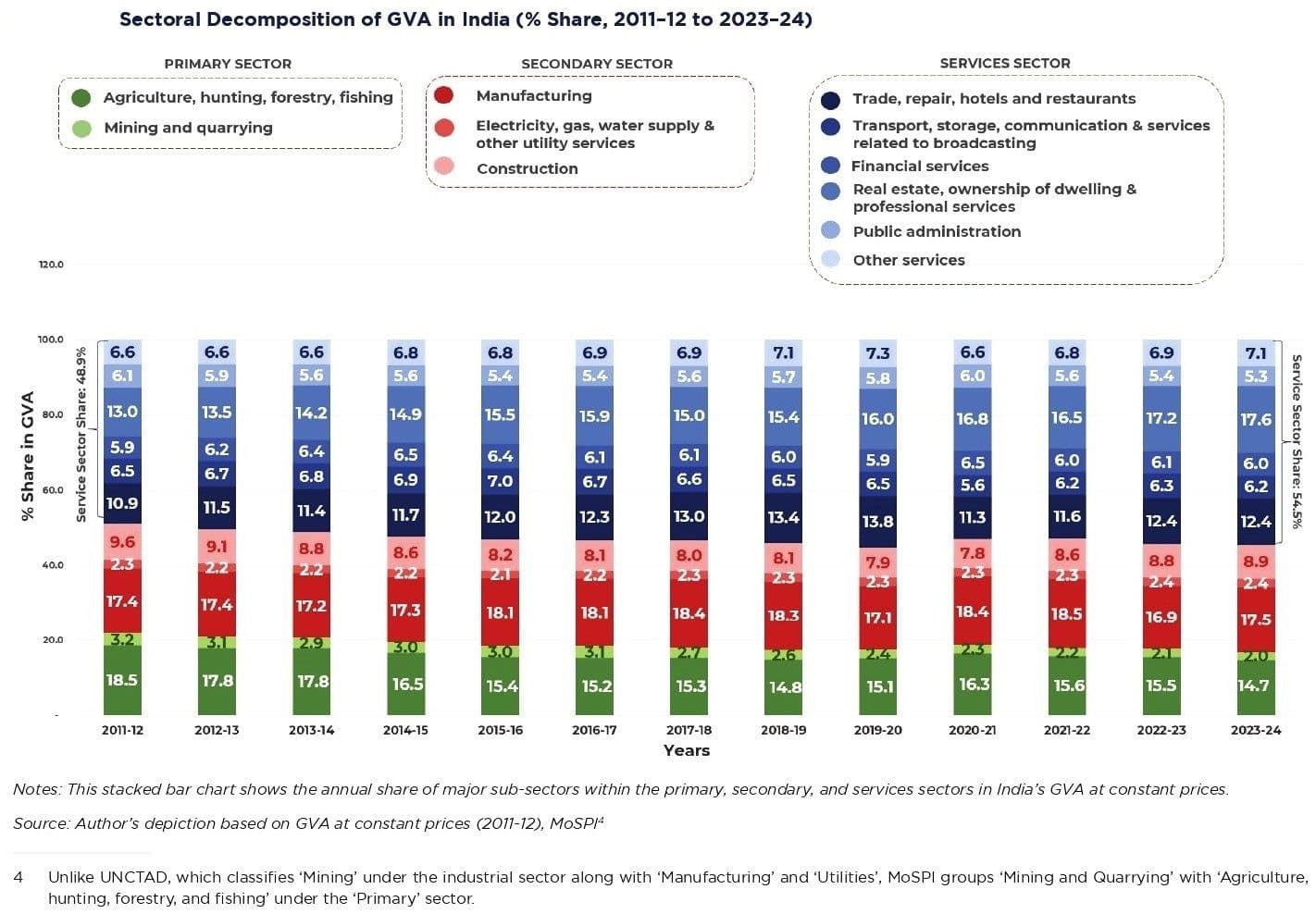

According to NITI Aayog’s latest report, ‘India’s Services Sector: Insights from GVA Trends and State-Level Dynamics’, released on Tuesday, services accounted for nearly 55% of India’s Gross Value Added (GVA) in 2024-25, while the primary and secondary sectors contribute 16% and 29%, respectively.

This early and decisive shift underscores a structural transformation that has made services the mainstay of India’s growth story—spanning modern, high-value industries such as IT, finance, real estate, and professional services, alongside traditional engines of employment like trade, transport, and hospitality.

B V R Subrahmanyam, Niti Aayog CEO, who launched report, said, “At the heart of India’s economic transformation lies the vitality and momentum of a rapidly evolving services sector. Ove the past two decades, services sector has emerged not only as a key driver of growth, innovation and employment, but also as a catalyst for regional development and social inclusion.”

A Structural Shift Anchored in Resilience

Between 2011-12 and 2023-24, India’s economic landscape underwent a quiet revolution. The share of agriculture and allied activities declined from 21.8% to 16.7%, while the industrial sector remained steady at around 28-29%. The services sector, meanwhile, rose from 49% to 54.5%, consolidating its dominance as the country’s growth engine.

Unlike the cyclical and climate-sensitive primary and secondary sectors, services have shown remarkable resilience. The pandemic amplified this strength — sectors such as IT, finance and professional services harnessed digital platforms to sustain momentum and drive recovery. Niti Aayog calls this the “most stable and resilient component of GVA”, highlighting services as a pillar of macroeconomic stability and long-term growth.

Inside the Services Sector: A Story of Diversity

The report’s classification of 15 service sub-sectors reveals that professional, scientific and business services (including real estate), trade and repair, and computer and information services together make up over half of the services GVA. Among them, IT and digital services have grown nearly four-fold since 2011-12, reinforcing India’s global reputation as a digital powerhouse.

Financial services and government administration have provided steady contributions, while education and health services gained prominence after the pandemic. On the other hand, transport, tourism and personal services — though more volatile — remain vital for employment and consumption.

Smaller segments like telecom, insurance, postal and audio-visual services are expanding rapidly with the rise of e-commerce and digital platforms. The report, however, cautions that the sector’s true developmental impact depends not only on its scale but on its quality, driven by productivity, tradability and formality.

Geography of Services: Uneven but Expanding

Services-led growth is far from uniform across India. States such as Karnataka, Telangana, Tamil Nadu, Kerala and Maharashtra have emerged as service powerhouses, where services contribute more than half of the Gross State Value Added (GSVA). Their advantages — urban centres, skilled talent pools, and strong digital infrastructure — fuel high-value activities in IT, finance and real estate.

Union Territories like Delhi and Chandigarh report services shares exceeding 85%, reflecting the dominance of urban economies. Encouragingly, several Northeastern states — including Meghalaya, Manipur, Nagaland and Arunachal Pradesh — are also witnessing rising service shares.

Meanwhile, states such as Punjab, Haryana, Uttar Pradesh, West Bengal, Rajasthan, Andhra Pradesh and Jharkhand show moderate progress, with services largely concentrated in traditional areas like trade, repair and public administration.

A clear pattern emerges: states with higher services shares tend to have higher per capita incomes — notably Delhi, Chandigarh, Karnataka, Telangana and Maharashtra. Yet, exceptions persist, highlighting how structural composition and sectoral quality shape outcomes more than the headline figures alone.

“Regions that had previously recorded relatively limited activity are now demonstrating sustained momentum, indicating a gradual of the (service) sector’s presence and influence,” the Niti Aayog CEO observed.

Can Services Drive Inclusive Growth?

To probe whether the services boom has been inclusive, the report employs two key measures — sigma (σ) and beta (β) convergence. Sigma convergence examines disparities across states, while beta convergence tests whether lagging states are catching up.

Results are mixed: while disparities (σ) have modestly widened since 2011-12, beta convergence shows that states starting with lower service shares are growing faster, signalling a gradual catch-up. The findings suggest that services-led growth is spreading geographically, though achieving true regional parity will demand stronger infrastructure, skill development, and institutional capacity.

“Variations in the composition of services, rather than aggregate size alone, carry significant implications for economic growth and development outcomes,” notes Dr Arvind Virmani, member, Niti Aayog.

Blueprint for the Future

The Niti Aayog proposes a four-quadrant classification of service subsectors — engines of growth, emerging stars, mature giants, and struggling segments — based on their GVA shares and growth rates from 2011-12 to 2023-24. This framework aims to guide policymakers toward targeted interventions: expanding high-performing sectors; nurturing emerging domains; modernizing mature but stagnant areas; and reforming underperforming segments.

Core policy thrusts include investing in digital infrastructure, innovation and skill ecosystems, as well as streamlining regulation and supporting the digital modernization of traditional services.

State-level strategies, tailored to local economic maturity and institutional readiness, stress three interlinked priorities: Building robust digital, spatial and institutional infrastructure; integrating services with local industries and upgrading workforce skills; and scaling decentralized service delivery to foster inclusive innovation.

Vision for 2047

As India charts its path to becoming a developed economy by 2047, the services sector stands at the forefront of this transformation. The report envisions a regionally balanced, digitally empowered, and innovation-driven services economy — one that boosts productivity, expands quality employment, and anchors long-term structural change.

In essence, India’s economic story is no longer about moving from farms to factories — but from factories to platforms. The services revolution, if steered inclusively, could well define the next chapter of India’s growth journey.