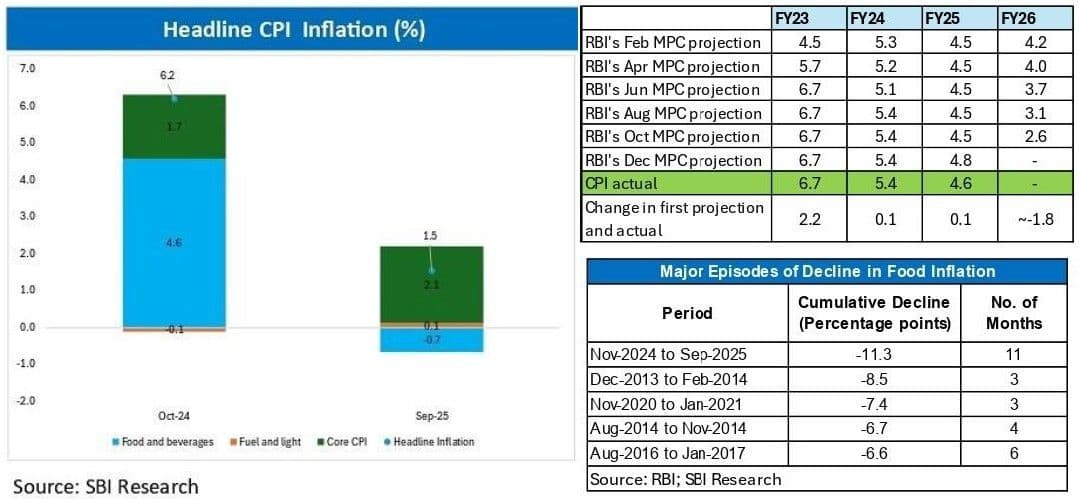

New Delhi: India’s retail inflation eased sharply to a 99-month low of 1.54% in September 2025, driven by a broad-based decline in food and beverages prices. This marks the 11th consecutive month of falling food inflation — the longest and deepest disinflationary stretch since the current CPI (consumer price index) series began.

The fall in inflation since October 2024 has been largely food-driven, as the contribution of food items turned from strongly positive to negative by September 2025. The moderation has pulled down the average inflation estimate for FY26 to 2.2%, well below the RBI’s 2.6% forecast, according to SBI Research's Ecowrap issued on Monday.

Vegetables, Pulses & Spices Lead Fall

Vegetable prices continued to remain deep in negative territory at -21.38% in September, compared to -15.92% a month earlier. Pulses inflation decelerated further to -15.32%, while spices too exhibited a decline during the month.

Fruits inflation dropped to 9.93%, while the oil and fats category fell by 18.34%, reflecting easing global edible oil prices and steady domestic supplies. However, personal care and effects inflation rose on account of higher gold prices, and housing CPI witnessed a modest uptick.

Two Phases of Disinflation

The fall in food inflation, unprecedented in both magnitude and duration, was marked by two distinct phases.

Phase I (Nov 2024-Apr 2025): Prices declined in absolute terms, sharply pulling down headline inflation.

Phase II (May-Sep 2025): Despite a seasonal uptick in prices, large favourable base effects kept year-on-year inflation subdued.

Economists note that the sequential easing reflects a structural correction in food inflation, aided by improved supply conditions and government interventions.

Cereals Inflation Softens Sharply

Cereals were a major contributor to the decline, with inflation in this category easing to 2.1% in September — the lowest since December 2021 — compared to 6.8% a year ago.

The moderation was underpinned by record rice production, which rose 8.2% in 2024-25, and ample buffer stocks, currently 3.5 times the norm as of mid-September. Wheat inflation too eased from 9.2% in February 2025 to 3.7% in September, helped by record output, healthy stock levels (1.2x the norm), and continuing export restrictions.

Increased Kharif sowing of rice, maize, urad and sugarcane is expected to keep price pressures muted in the coming months, though post-monsoon excess rains could pose localised risks.

Core Inflation & Regional Trends

Exclusion-based measures of inflation also point to easing pressures. Core CPI (excluding gold) stood at 3.28%, while inflation excluding food, fuel, petrol, diesel, gold and silver components eased to 3.3%, 127 basis points below the conventional core measure.

Regionally, both urban and rural inflation have been easing since October 2024. The higher food weight in the rural CPI basket, coupled with a steeper decline in food prices, has kept rural inflation below urban levels since March 2025.

During April-September 2025, 31 out of 36 States and Union Territories reported inflation below 4%. Kerala was the key exception, with a sharp rise in headline inflation due to a spike in coconut and coconut oil prices.

Policy Implications

Analysts suggest the sharp and sustained disinflation provides ample space for the RBI to pivot toward monetary easing, even as the central bank remains cautious.

“With inflation persistently undershooting forecasts, the RBI risks staying behind the curve if it continues to delay rate cuts,” said an economist. “It’s better to err on the side of policy support now than to miss the opportunity when disinflation is entrenched.”

Given the current trend, inflation could dip further to around 0.45% in October, strengthening the case for a decisive rate cut in the upcoming Monetary Policy Committee meeting.

For now, the FY27 inflation trajectory is projected at 3.7%, suggesting that the disinflationary cycle may be broad-based and durable.