New Delhi: A nationwide survey by the Securities and Exchange Board of India (Sebi) has unveiled a stark contradiction in the Indian financial landscape. While awareness of stock markets is at an all-time high, actual participation remains dismally low, with a vast majority of households sitting on the sidelines. For the small minority who do invest, social media fin-fluencers have become the dominant source of advice, overshadowing traditional financial experts and raising significant concerns for the market regulator.

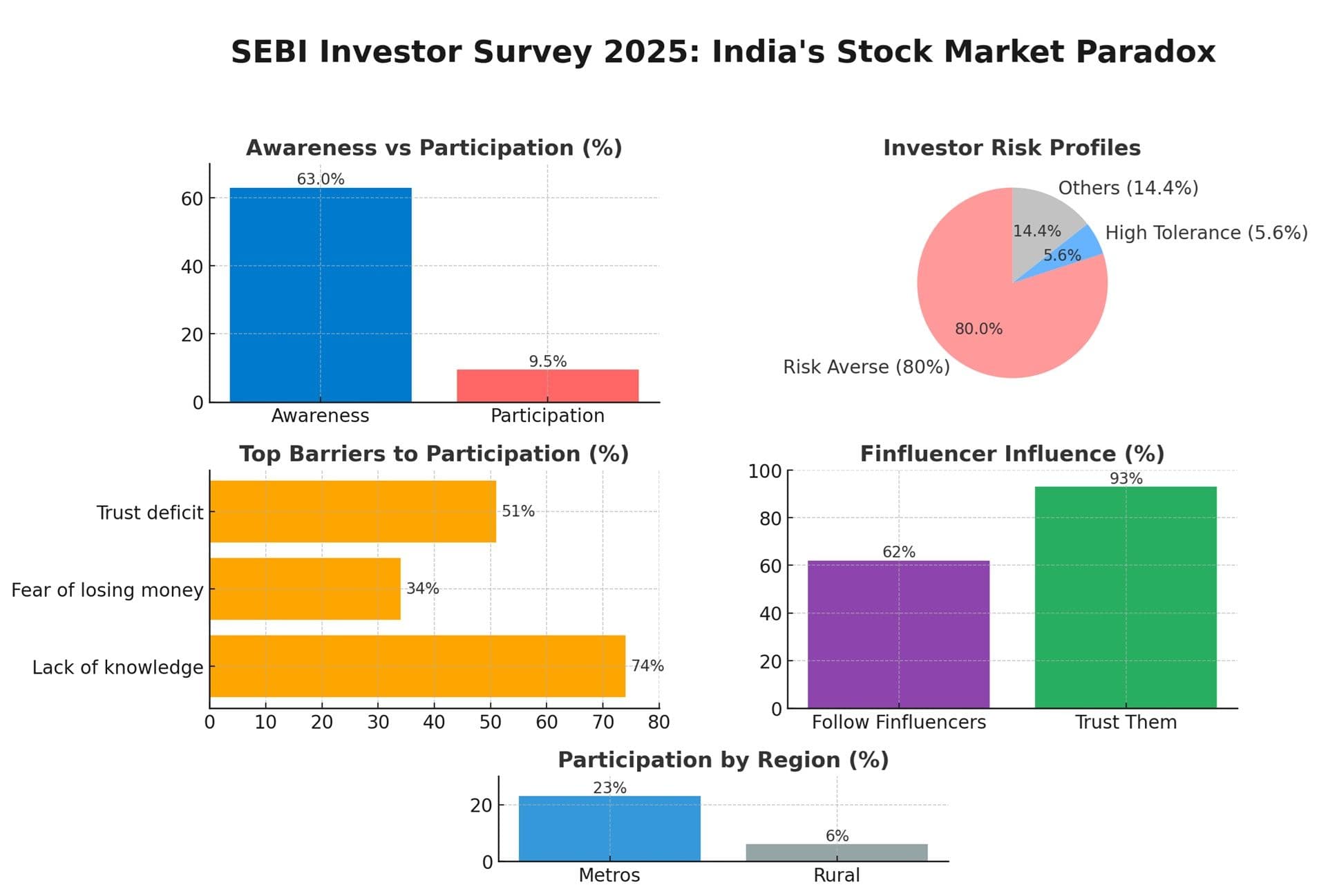

The Sebi Investor Survey 2025, conducted by Kantar and covering 91,950 households, reveals that a record 63% of Indian households (approximately 213 million) are aware of securities market products like stocks and mutual funds. However, this awareness fails to translate into action. The actual participation rate is a mere 9.5%, meaning only about 32.1 million households are actively investing. This highlights a massive, untapped reservoir of retail capital missing out on India’s economic growth story.

The core of the issue lies in the deeply risk-averse nature of the Indian household. Nearly 80% of families prioritise the safety of their capital over seeking high returns. Only 5.6% of the population demonstrates a high risk tolerance, willing to endure short-term losses for potential long-term gains. This aversion is reflected in the low penetration of financial products: while 53% know about mutual funds and ETFs, only 6.7% invest in them. Similarly, 49% are familiar with stocks, but just 5.3% own them.

Fear, Complexity, Deep Trust Deficit

The report meticulously details the barriers preventing Indians from entering the stock market. The primary obstacle is a combination of complexity and information gaps. An overwhelming 74% of non-investors cite a lack of knowledge about how products work, not knowing how to start investing, and confusion from information overload as their main hurdles. The single largest barrier, cited by 34% of non-investors, is the “fear of losing money due to market risks”. Compounding this fear is a profound trust deficit. A significant 51% of non-investors are held back by a lack of trust in financial products and institutions themselves. The survey also highlights a clear demographic divide. Market penetration is 23% in the top nine metros but plummets to just 6% in rural areas. Participation is highest among post-graduates (27%) and salaried employees (23%), compared to a mere 4% among those in agriculture.

Despite these barriers, Sebi has identified a promising segment: the “intenders”. This group constitutes 22% of aware non-investors who plan to start investing within the next year. They are primarily motivated by the prospect of higher returns and quick gains from small investments. However, their focus on quick profits, coupled with limited knowledge, presents a challenge, as their expectations may be dangerously misaligned with market realities.

Credibility and Concerning Influence

For the 10% of Indians who do participate in the market, the source of investment advice has undergone a dramatic shift. The survey reveals a seismic move away from formal channels towards social media. An astonishing 62% of retail investors admit to making their investment decisions based on recommendations from fin-fluencers. This reliance is underpinned by an exceptionally high level of perceived credibility.

The Sebi study found that 93% of the followers of these online financial influencers find them “moderately to highly” credible. This trust persists despite Sebi’s ongoing crackdown on unregistered fin-fluencers for fraud and misinformed guidance. As of October 2024, the regulator had taken down 70,000 such accounts, yet their influence remains largely undiminished.

YouTube is the dominant platform for this content, with 9 out of 10 investors consuming fin-fluencer material on the video-sharing site. This preference for video aligns with the broader investor education trends identified in the survey, where 80% of investors prefer videos for learning, and 69% rely on social media posts.

The rise of fin-fluencers is partly attributed to the explosive growth in registered investors, which has increased fivefold to over 20 million between 2019-20 and 2024-25. Key enablers include the ease of opening documents and user-friendly trading platforms, cited by over 85% of intermediaries.