Photo courtesy: Unsplash

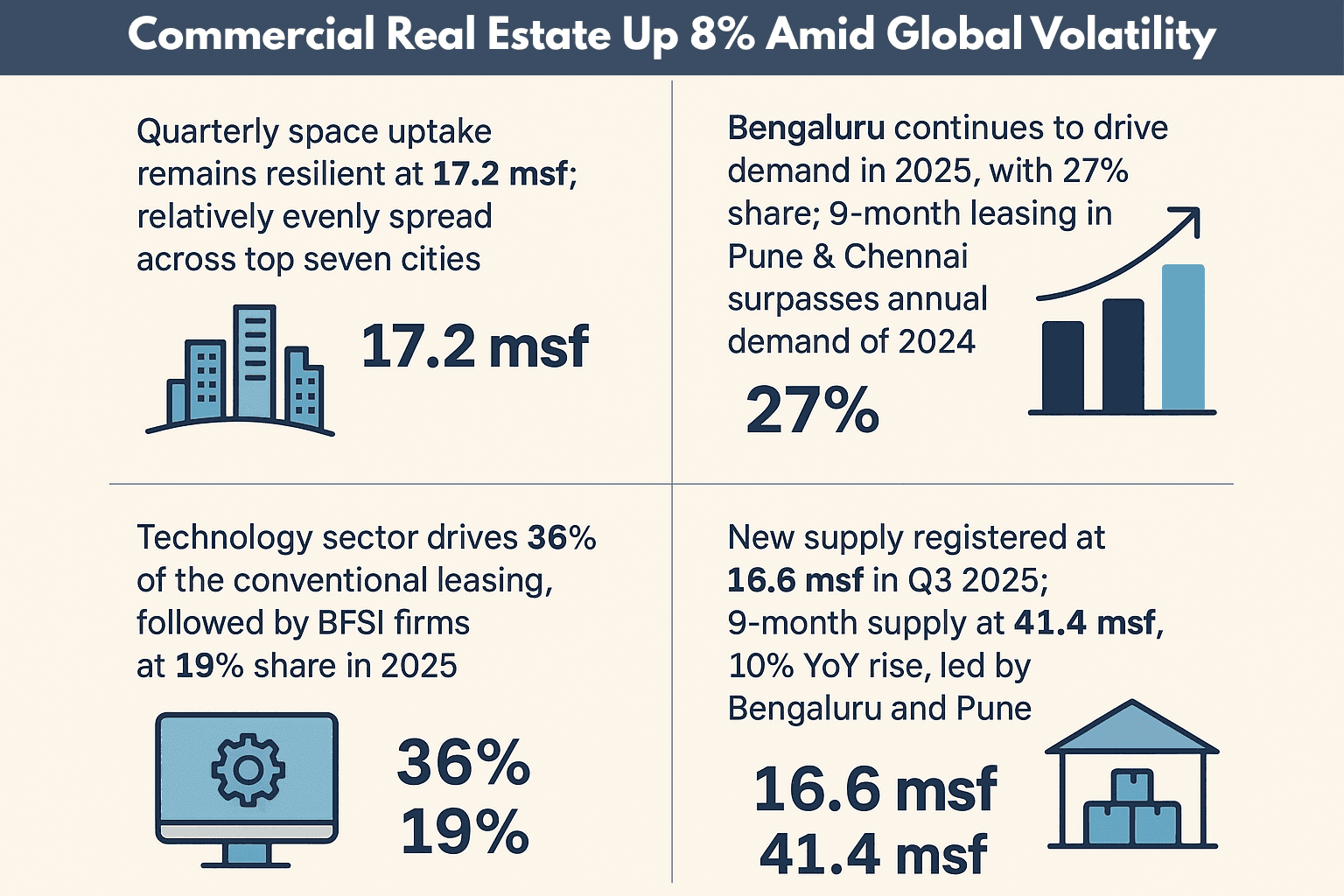

New Delhi: Leasing activity across India’s top seven office markets continued to demonstrate remarkable resilience in 2025 amid global geopolitical volatility, with total space uptake reaching 50.9 million sq ft in the first three quarters, logging an 8% year-on-year (YoY) growth. Despite a marginal quarterly dip to 17.2 million sq ft in Q3 2025, the broader trend remains decisively upward, underscoring the strength of India’s commercial real estate sector amid global economic volatility.

Bengaluru remained the undisputed leader, accounting for 27% of India’s total office demand and clocking 14 million sq ft of leasing during the nine-month period. However, the spotlight this year has also shifted to Pune, Mumbai and Chennai, which collectively accounted for more than half of the Q3 leasing volume. Each of these cities recorded over 40% YoY growth, highlighting a broad-based expansion across India’s major commercial hubs.

Colliers India’s analysis notes that the momentum has been well-balanced across the country’s top office markets. Chennai, Delhi NCR, Hyderabad, Mumbai and Pune each recorded 6-8 million sq ft of leasing activity so far this year, signaling a healthy and geographically diversified demand landscape.

“India’s office market continues to demonstrate resilience, crossing the 50 million square feet benchmark in the first nine months of the year, despite ongoing external volatilities and trade frictions,” said Arpit Mehrotra, managing director (office services – India), Colliers.

The robust demand has been underpinned by global capability centers (GCCs) and domestic corporates, with GCCs alone leasing nearly 20 million sq ft in 2025 — contributing about 40% of total office demand. Analysts expect total office absorption to approach 70 million sq ft by year-end, as global tech firms expand their India operations.

Tech, BFSI power momentum

The technology sector continues to be the backbone of India’s office market, accounting for 36% of total leasing in the first three quarters of 2025. Tech occupiers leased over 15 million sq ft, reflecting a 24% YoY growth, driven primarily by GCC expansions. The BFSI sector followed closely with a 19% share, while flex operators further strengthened their footprint amid growing demand for agile workspaces.

Flex space leasing in 2025 has already touched 9.2 million sq ft, near its all-time high, as occupiers increasingly adopt hybrid workplace models. In Q3 2025 alone, flex operators accounted for 2.7 million sq ft, representing a solid 16% share of quarterly leasing.

“Office space demand in Q3 2025 was driven by technology and BFSI occupiers, which together accounted for nearly 60% of conventional leasing,” said Vimal Nadar, national director and head of research, Colliers India. Bengaluru remained the epicentre of tech demand, while Pune led the BFSI surge, contributing over 40% of finance-sector leasing.

The new supply pipeline also stayed robust, with 16.6 million sq. ft. of completions in Q3 2025 — a 15% YoY increase. Pune led with a fourfold jump in new completions, followed by Bengaluru and Delhi-NCR. Across the first nine months of the year, total new supply reached 41.4 million sq ft, with Bengaluru and Pune together contributing more than half of this figure.

Despite the influx of new supply, vacancy levels remained stable at 16.4% nationally, suggesting that demand continues to outpace supply in most markets. While Pune and Delhi-NCR saw slight vacancy upticks due to new project completions, the overall occupancy environment remains firm.

Meanwhile, rentals continue to edge upward across most top cities. Sustained demand, healthy pre-commitments, and constrained supply in select micro-markets have bolstered landlords’ pricing power. The Indian office market’s wide rental spectrum continues to attract global occupiers seeking cost-effective consolidation opportunities in high-quality Grade A assets.

With technology, BFSI, and flex space driving sustained demand and GCC expansions strengthening India’s global office positioning, the country’s commercial real estate market remains on track for one of its strongest years in the post-pandemic era.